Bortezomib for injection by Jianyou Co., Ltd. was approved in the United States for the treatment of myeloma and lymphoma.

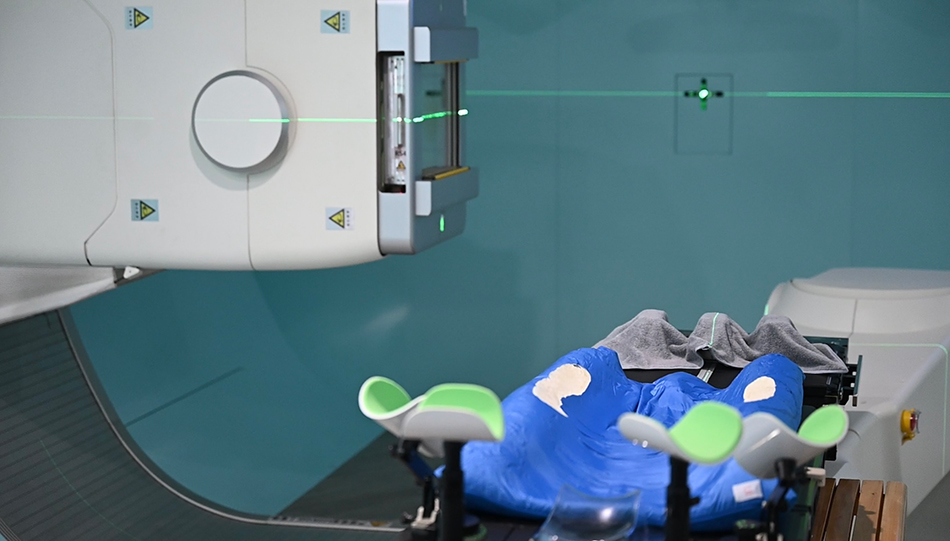

On July 27th, () announced that Bortezomib for injection (3.5mg/ bottle) of subsidiary Jianjin Pharmaceutical received the notice of ANDA (Simple Application for Generic Drugs) issued by the US Food and Drug Administration (FDA), and the indications were multiple myeloma and mantle cell lymphoma. Up to now, the R&D expenses invested in this product R&D project are about RMB 10,333,400.

It is reported that the ANDA application for bortezomib for injection (3.5mg/ bottle) was temporarily approved in March 2020. The original research related patents of this product expired on July 25th, 2022, and Jianjin Pharmaceutical was finally approved by the FDA for bortezomib for injection on July 26th, 2022.

Bortezomib is a bispeptide borate analogue, and it is the first synthetic new competitive inhibitor of proteasome in clinic in the world, which is used for the treatment of multiple myeloma and mantle cell lymphoma. The original product of bortezomib for injection (3.5mg/ bottle) was held by TAKEDA PHARMS USA under the trade name VELCADE, which was approved by FDA on May 13th, 2003 and authorized to be listed in the European Union on April 26th, 2004.

Upon inquiry, 18 companies of bortezomib for injection, such as BAXTER, FRESENIUS KABI and HOSPIRA, have been approved by the FDA. In 2021, the sales of bortezomib for injection in the United States market was about $1.043 billion.

ST Rongtai: The proposal of transferring chemical assets to subsidiaries was approved by the EGM.

() On July 28th, it was announced that the company held the resolution of the third extraordinary general meeting of shareholders in 2022 on July 27th, and reviewed and approved the Proposal on Transferring Assets to a wholly-owned subsidiary.

According to the proposal, in order to further improve and optimize the existing business structure and management structure, meet the needs of business integration, improve the efficiency of business management and achieve the company’s strategic objectives, the company will transfer the relevant assets, creditor’s rights, debts, personnel, rights and obligations involved in the existing chemical business to Guangdong Rongtai New Materials Co., Ltd., a wholly-owned subsidiary, with June 30, 2022 as the base date.

According to the data, ST Rongtai’s main business is chemical materials and Internet integrated services. The data shows that in 2021, the company’s Internet integrated service business income was about 299 million yuan, a year-on-year increase of 6.72%; The revenue from chemical materials business was about 469 million yuan, a year-on-year decrease of 40.18%.

Previously, ST Rongtai said in the 2021 annual report that due to the increasingly fierce competition in the chemical industry, the company will withdraw from the chemical materials business in an orderly manner and further expand the Internet service business. In the future, the Internet business will gradually become the main development direction of the company.

According to the plan, combined with the strategic deployment of the country’s "East Counting and West Computing", ST Rongtai plans to lay out a nationwide integrated big data center system, build an operation data center at key computing hub nodes, and strive to provide a variety of service models for industry customers, and strive to build a green, low-carbon, safe and reliable digital infrastructure. Among them, the company’s Rongtaiyun data center located in the Beijing-Tianjin-Hebei hub, an important node of "East Counting and West Computing", is accelerating construction.

While withdrawing from the chemical industry and focusing on the Internet business, the equity structure of ST Rongtai has also undergone major changes recently. On July 13, ST Rongtai announced that 5% of the shares transferred to Gao Dapeng by Guangdong Rongtai Advanced Porcelain Co., Ltd., the controlling shareholder, had completed the securities transfer registration procedures on July 11, and Gao Dapeng’s shareholding ratio increased to 16.76%.

At the same time, Xingsheng Chemical and Jian Xiao, shareholders of ST Rongtai, signed the Share Transfer Agreement on July 13th, and Xingsheng Chemical intends to transfer 45,405,900 shares of the company’s unrestricted shares to Jian Xiao, accounting for 6.45% of the company’s total share capital. According to the announcement, Xingsheng Chemical is controlled by Yang Baosheng, the actual controller of ST Rongtai. After the completion of the transfer of the above agreement, Gao Dapeng passively became the largest shareholder of the company, with a shareholding ratio of about 16.76%; Jian Xiao’s shareholding ratio is 12.99%; The total shareholding ratio of the controlling shareholder Senior Porcelain and its concerted actions, Yang Baosheng and Xingsheng Chemical, dropped to 11.97%.

Guang’ an Aizhong completed the power generation of 785 million kWh in the first half of the year, up 0.32% year-on-year.

() Announced that the company completed the power generation of 785 million kWh from January to June 2022, a year-on-year increase of 0.32%; The electricity sold to the district was 839 million kWh, up 8.37% year-on-year.

Senter shares won the bid for 311 million yuan of metal roofing project.

() Announcement, the company recently received the Notice of Winning Bid from China Construction Eighth Engineering Bureau Co., Ltd., confirming that the company won the bid for the metal roofing project of the first bid section of the terminal area of Hohhot New Airport with a loan from New Development Bank, and the winning bid amount was 311 million yuan.

Senter shares won the bid for 311 million yuan of metal roofing project.

Sant shares announced that the company recently received the Notice of Winning Bid from China Construction Eighth Engineering Bureau Co., Ltd., confirming that the company won the bid for the metal roofing project of the first bid section of the terminal area of Hohhot New Airport with a loan from New Development Bank, and the winning bid amount was 311 million yuan.

Nanjing Pharmaceutical Subsidiary intends to lease and renovate some factories of Zhongshan Pharmaceutical.

() Announced that Nanjing Heling pharmacy service Co., Ltd. ("Heling Pharmaceutical Affairs"), a wholly-owned subsidiary of Nanjing Pharmaceutical Co., Ltd. ("Nanjing Pharmaceutical"), intends to lease and renovate part of the factory building of Nanjing Zhongshan Pharmaceutical Co., Ltd. ("Zhongshan Pharmaceutical") located at No.21 Hengfa Road, Nanjing Economic Development Zone, for storage and office. The total lease area is about 8426.1㎡, the lease period is 10 years, and the total cost of lease renovation is about 50,334,500 yuan.

Sant shares: the project that won the bid of 311 million yuan accounted for about 10% of last year’s revenue.

Saint announced on the evening of July 28th that the company won the bid for the metal roofing project of the first bid section of the terminal area of Hohhot New Airport loaned by New Development Bank, with the winning bid amount of 311 million yuan, accounting for about 10% of the company’s audited operating income in 2021.

Huaxing Yuanchuang: Yuanhua Chuangxing transferred 800,000 "Huaxing Convertible Bonds".

Huaxing Yuanchuang issued an announcement. On July 28th, the company received a letter from the bondholder Yuanhua Chuangxing, and learned that it had transferred 800,000 "Huaxing Convertible Bonds" through the integrated electronic platform of fixed-income securities of Shanghai Stock Exchange by means of designated counterparty transactions, and the change in holding ratio reached 10% of the total issuance.

Bohai Chemical: PDH plant, a wholly-owned subsidiary, temporarily stopped production due to failure.

() Announced on the evening of July 28th, the company received a notice from Bohai Petrochemical, a wholly-owned subsidiary, that PDH plant was shut down for maintenance due to equipment failure, and the shutdown time is expected to be about 3 days.

Wu Yinghong, the controlling shareholder of Changqing, has pledged 30.96 million shares.

() Announcement was issued. On July 28, 2022, the company received a notice from Mr. Wu Yinghong, the controlling shareholder of the company, and learned that he had gone through the registration procedures of releasing the pledge and re-pledging some shares of the company. On July 25th, it pledged 41.31 million shares, accounting for 20.25% of the company’s total share capital. On July 27th, Mr. Wu Yinghong went through the procedures of share pledge, and pledged his 30.96 million shares of the company again, accounting for 15.18% of the company’s total share capital. After this pledge, Wu Yinghong has pledged a total of 30.96 million shares.

Xiantan Co., Ltd.: Signing a strategic cooperation agreement to promote the development of the whole industrial chain of prefabricated vegetables

() On the evening of July 28th, the company announced that it had signed the Strategic Cooperation Agreement with Qingdao () Cold Chain Integration Co., Ltd. and Asepu (Qingdao) Economic and Trade Development Co., Ltd.. In this cooperation, we will seize the opportunity of the prefabricated vegetable industry and the development of RCEP, build a perfect cold chain logistics system for prefabricated vegetables around the product characteristics, improve all links of prefabricated vegetables from the field to the table, and reduce the cost and improve the efficiency of the storage and transportation of prefabricated vegetables through technical research and development. Take the lead in building RCEP prefabricated vegetable industrial base and promoting the development of the whole industrial chain of prefabricated vegetables.

The reorganization of Yangtze Power was accepted by China Securities Regulatory Commission.

() Announcement. Previously, the company planned to purchase 100% equity of Three Gorges Jinshajiang Yun Chuan Hydropower Development Co., Ltd. jointly held by China Yangtze Three Gorges Corporation, Yangtze Three Gorges Investment Management Co., Ltd., Yunnan Energy Investment Group Co., Ltd. and Sichuan Energy Investment Group Co., Ltd. by issuing shares and paying cash, and at the same time raise matching funds through non-public offering of shares.

On July 27th, 2022, the company received the Acceptance Form for Administrative License Application of China Securities Regulatory Commission issued by China Securities Regulatory Commission (hereinafter referred to as "China Securities Regulatory Commission") (acceptance serial number: 221750). China Securities Regulatory Commission has reviewed the application materials for administrative license related to this reorganization submitted by the company according to law, and decided to accept the application for administrative license because the application materials are complete and conform to the legal form.

The subsidiary of China Merchants Steamship plans to sell an aging ro-ro ship for 25.8 million yuan.

() It was announced that Shenzhen Ro-Ro, a subsidiary of the company, recently signed a sales agreement with Pan-China Ocean, an independent third party, for an 801-parking non-energy-saving and environment-friendly ro-ro ship. Based on market principles, the buyer and the seller were publicly listed on the property rights exchange, and the final transaction price was RMB 25.8 million.

According to the company, in order to adapt to the trend of low-carbon environmental protection and green ships, with the approval of the company’s board of directors, the company intends to further optimize the ship types and ship age structures of its fleets, including ro-ro ships, by ordering new ships, disposing of old ships and upgrading technology, so as to further increase the proportion of energy-saving and environment-friendly ships and enhance the market competitiveness and customer service ability of its fleets. After this round of sale, the number of ro-ro ships in operation was temporarily reduced to 22, with an average age of about 8.68 years.

The controlling shareholder of Xuguang Electronics pledged 40 million shares and pledged 25.71 million shares.

() Announcement was issued. On July 28, 2022, the company received a notice from the controlling shareholder, New Group Co., Ltd. (hereinafter referred to as "New Group") about the pledge and pledge of some shares. This time, 40 million shares were pledged, accounting for 7.36% of the company’s total share capital; 25.71 million shares were pledged this time, accounting for 4.73% of the company’s total share capital.

Shimao shares: "20 Shimao G2" will begin to pay annual interest on August 1st.

Coupon rate 3.76% in the current period.

On July 28th, () announced the interest payment announcement of "20 Shimao G2" in 2022.

The announcement shows that "20 Shimao G2" will start to pay interest from July 7, 2021 to July 6, 2022 on August 1, 2022 (as July 30, 2022 is a non-trading day, it will be postponed to the first trading day thereafter).

It is reported that "20 Shimao G2" was publicly issued in China on July 7, 2020, with a total issuance scale of 1 billion yuan, the current balance is about 950 million yuan, and the current coupon rate is 3.76%. After adjustment according to the "Proposal on Principal and Interest Payment Arrangement", the term of this bond is 2 years +2 years.

Mengtian Home elected Hu Cunji as the chairman of the company’s supervisory board.

High school diploma

On July 28th, () announced that the Sixth Meeting of the Second Board of Supervisors reviewed and approved the Proposal on Electing the Chairman of the Board of Supervisors of the Company, and elected Hu Cunji as the Chairman of the Second Board of Supervisors of the Company, with a term of office from the date of adoption of this meeting of the Board of Supervisors to the date of expiration of the current term of the Board of Supervisors.

Hu Cunji, male, Han nationality, born in April 1975, has a high school education. Since September 1, 1995, he has served as a buyer, salesman, cashier, chief of single department in purchasing department, chief of supplier development in purchasing department, chief of audit department, chief of quality comparison department, manager of purchasing and development department 2, and manager of hardware service department in Mengtian Home Furnishing Group Co., Ltd.

Hu Cunji holds 0.7118% of the property share of Jiaxing Mengyue Investment Management Partnership (Limited Partnership), and Jiaxing Mengyue Investment Management Partnership (Limited Partnership) directly holds 3.75% of the shares of the company after this issuance.

Hiromi Paper, the shareholder of Yongji, plans to transfer 8.4 million shares to Huang Qingshi.

() Announcement. Recently, the company received a notice from the company corporate shareholders Hiromi Paper, and learned that it signed the Share Transfer Agreement (the "Agreement") with Huachuang Securities and Huang Qingshi (the transferee) on July 27, 2022, which agreed to transfer 8.4 million shares of the company held by Hiromi Paper to Huang Qingshi at a price of 5.62 yuan per share.

Zhonggu Logistics announced the half-year equity distribution plan for 2022, and plans to send 10 12 yuan.

() Financial News () issued an announcement on July 29th, and the contents of the company’s half-year equity distribution plan for 2022 are as follows: based on the total share capital of 1,418,961,600 shares, a cash dividend of 1.200 billion yuan will be distributed to all shareholders for every 10 shares, accounting for 110.45% of the net profit attributable to the mother in the same period, and no bonus shares will be distributed and no capital reserve will be converted into share capital.

According to the semi-annual performance report released by Zhonggu Logistics in 2022, the company’s operating income was 7.228 billion yuan, a year-on-year increase of 28.98%; The net profit attributable to shareholders of listed companies was 1.542 billion yuan, a year-on-year increase of 40.04%; The basic earnings per share was 1.09 yuan, compared with 0.86 yuan in the same period last year.

The main business of Shanghai Zhonggu Logistics Co., Ltd. is container logistics service. Its main products and services are logistics services.

(Source: Straight Flush iFinD)

ST Kao’s new contract amount in the second quarter was 9,843,200 yuan.

() Announced that in the second quarter of 2022, the company and its subsidiaries signed 46 new construction business contracts and planning and design contracts with a total amount of 9,843,200 yuan. In 2022, the company and its holding subsidiaries signed a total of 93 contracts with a total amount of 40,399,700 yuan. Up to now, the above contract is being performed.

Longgao Co., Ltd. plans to invest 50 million yuan to participate in the Red Soil No.1 Fund under Shenzhen Venture Capital.

() Announce that in order to implement the company’s development strategy of "market-oriented extension M&A", actively explore investment opportunities for projects, and create new growth points in performance, the company plans to subscribe 50 million yuan with its own funds to participate in the Red Soil No.1 Fund under the Shenzhen Venture Capital.

Hongtu No.1 Fund, initiated by Shenzhen Venture Capital, complies with the development trend of national strategic emerging industries and the market financing demand, and mainly invests in growth and mature projects in strategic emerging industries, covering core investment areas such as Guangdong-Hong Kong-Macao Greater Bay Area, Yangtze River Delta and Bohai Rim. The company subscribed for the shares of Hongtu No.1 Fund and became a limited partner of the fund, sharing the investment income of the fund according to the overall income and distribution principle of the fund. At the same time, the company and Shenzhen Venture Capital take fund cooperation as an opportunity and link to strengthen cooperation in upstream and downstream expansion and diversified business layout of inorganic nonmetallic mineral industry chain.

Founder Securities intends to cancel Hebei Branch.

Founder Securities announced that in order to optimize the layout of the company’s branches, the company decided to cancel Hebei Branch of Founder Securities Co., Ltd. (hereinafter referred to as "Hebei Branch") after deliberation by the company’s executive committee. Hebei Branch has now properly handled customer assets, settled its securities business and terminated its business activities.

On July 27, 2022, the company received the Notice of Registration [(Shi) Dengzi [2022] No.2382] issued by the Shijiazhuang Municipal Administrative Examination and Approval Bureau, and approved the cancellation of registration of Hebei Branch.

PDH unit of Bohai Petrochemical Company, a subsidiary of Bohai Chemical Company, temporarily stopped production due to failure.

Bohai Chemical announced that the company received a notice from Tianjin Bohai Petrochemical Co., Ltd. ("Bohai Petrochemical"), a wholly-owned subsidiary, that the PDH plant was shut down for maintenance due to equipment failure, and the shutdown time is expected to be about 3 days.

The purchase price of the land located in Nanchang High-tech Zone under the name of Fangda Special Steel is about 185 million yuan.

() Announced that the Management Committee of Nanchang High-tech Industrial Development Zone ("Nanchang High-tech Industrial Development Zone Management Committee") plans to purchase and store the company’s land use right of 173.5665 mu in the west of Innovation Road and south of Aixihu Road in Nanchang High-tech Industrial Development Zone. The company ("Party B") intends to sign the State-owned Land Use Right Reserve Contract ("Contract") with Nanchang Land Reserve Center ("Party A"), and the total purchase price of the land and the above-ground assets involved in this purchase is 185 million yuan.

It is reported that the purchase price includes part of the equipment asset price of Jiangxi Fangda Changli Auto Parts Co., Ltd., a wholly-owned subsidiary of the company, and the company will pay part of the money to Jiangxi Fangda Changli Auto Parts Co., Ltd. after receiving the purchase price. After deducting related costs and expenses, this transaction is expected to increase the company’s income and have a certain impact on the company’s 2022 annual performance.

Huadian power international: Ding Huande resigned as chairman.

Huadian power international announced that the company had received the resignation report of Mr. Ding Huande, the chairman and director of the company, on July 28th, 2022. Due to his age, Mr. Ding Huande applied to resign as the Chairman, Director and Chairman of the Strategy Committee of the Ninth Board of Directors of the Company. Mr. Ding Huande’s application for resignation will take effect after the new directors are elected at the company’s general meeting of shareholders.

Zhongyan Chemical’s application for non-public offering of A shares was approved by CSRC.

() Announcement: Recently, the company received the Reply of China Securities Regulatory Commission on Approving the Non-public Issuance of Shares of Zhongyan inner mongolia chemical Co., Ltd., and approved that the company will issue no more than 287 million new shares in a non-public manner. If the total share capital changes due to capitalization, the number of this issuance can be adjusted accordingly.

Heli Technology: Shareholders intend to reduce their holdings by no more than 3%.

() On the evening of July 28th, it was announced that the shareholder of the company, Shanghai Daixi Investment Management Co., Ltd.-Daixi Strategic Emerging Industry Growth No.1 Private Equity Investment Fund, planned to reduce the company’s shares by no more than 4.704 million shares and no more than 3% of the company’s total share capital.

Daixi Investment, the shareholder of Heli Technology, plans to reduce its shareholding by no more than 3%.

Heli Technology announced that Daixi Investment, a shareholder of the company, plans to reduce its shareholding by no more than 1.568 million shares within 6 months after 15 trading days from the disclosure date of this announcement, and no more than 1% of the company’s total share capital; Within six months after three trading days from the date of disclosure of this announcement, the company’s shares will be reduced by block trading, not exceeding 3.136 million shares, not exceeding 2% of the company’s total share capital.

Promote the development of the whole industrial chain of prefabricated vegetables! Xiantan Co., Ltd. cooperated with Aucma Cold Chain and Asepu to build RCEP prefabricated vegetable industry base.

On the evening of July 28th, Xiantan Co., Ltd. (stock code: 002746, hereinafter referred to as "the Company") announced that it had signed the Strategic Cooperation Agreement with Qingdao Aucma Cold Chain Integration Co., Ltd. (hereinafter referred to as "Aucma Cold Chain") and Asepa (Qingdao) Economic and Trade Development Co., Ltd. (hereinafter referred to as "Asepa"). Based on the principle of "complementary advantages, resource sharing, market operation and win-win cooperation", the three parties have established a long-term, comprehensive and in-depth strategic cooperation mechanism and formed an all-round strategic partnership in the fields of product cold chain logistics and overseas market export.

It is understood that this cooperation will take the products of Xiantan Co., Ltd. as the origin, Aucma cold chain wisdom full cold chain technology as the basis, and Asepa RCEP comprehensive service as the core, giving full play to the industrial accumulation, industrial experience and industrial contacts of all parties at home and abroad, and building a perfect cold chain logistics trade system for prefabricated vegetables. Improve all aspects of prefabricated vegetables from the field to the dining table, and make the storage and transportation of prefabricated vegetables reduce costs and improve efficiency through technical research and development. Take the lead in building RCEP prefabricated vegetable industrial base and promoting the development of the whole industrial chain of prefabricated vegetables.

At present, Xiantan Co., Ltd. owns many kinds of chicken food and prefabricated vegetable products. Through the company’s "company+autotrophic farm+farm" model for many years, it has deeply bound the upstream farmers and has a perfect production, processing and sales system. In the future, Xiantan Co., Ltd. will continue to deeply research and develop new prefabricated vegetable products and explore new modes of rural revitalization.

In addition, in this cooperation, Xiantan Co., Ltd. will use the platform of listed companies to give full play to the comprehensive advantages of well-known product brands, years of industrial accumulation, industry management experience and other aspects, and act as a product exporter in the cooperation, providing documents and high-quality and low-cost products such as divided frozen chicken products, chilled chicken products and prepared foods in accordance with the inspection and quarantine requirements of RCEP member countries.

Xiantan Co., Ltd. said that this strategic cooperation is an important embodiment of the company’s strategic layout, which will have a positive impact on the expansion of the company’s chicken products and prefabricated dishes in the domestic and international markets, help to enhance the company’s market competitiveness and industry competitiveness, follow the company’s strategic development plan, and accelerate the company’s strategic landing and transformation towards a green, healthy, efficient and safe "big food+big consumption" integrated industrial chain enterprise.

Juhua Co., Ltd. plans to invest 1.576 billion yuan to implement the 150,000 tons/year special polyester chip new material project.

() Announcement: In order to give full play to the location advantages and existing comprehensive advantages of Ningbo Petrochemical Economic and Technological Development Zone where Ninghua Company is located, strengthen and improve the petrochemical new materials business of the large company, promote the transformation and upgrading of Ninghua Company, and improve the economic benefits and comprehensive competitiveness of the company, according to the "Development Strategy of the Company’s Petrochemical New Materials Industry" of "focusing on the development of advanced petrochemical materials", it was approved by the board of directors of the company at the 20th meeting of the 8th session.

The total investment of this project is 1.576 billion yuan. It is planned to introduce international mature technology to produce 1,3-propanediol (PDO) from ethylene oxide, and then PTT (Poly (trimethylene terephthalate)) will be produced from purified terephthalic acid (PTA) and PDO. Product scheme of this project: 150,000 tons/year PTT; 7.2 tons/year PDO (including 10,500 tons of commodities and 61,500 tons of intermediate products). The implementation of this project includes the main device of 7.2 tons/year PDO and 15 tons/year PTT and its supporting projects. It is planned to be completed by the end of October 2024 and put into trial operation by the end of 2024.

The implementation of this project can give full play to the advantages of Ninghua Company’s location and industrial base, promote the transformation and upgrading of Ninghua Company to advanced petrochemical materials, strengthen and improve the petrochemical new materials business of the company, enhance industrial competitiveness and profitability, and enhance the industrial competitive position, which is of positive significance for promoting the transformation and upgrading of the company to new chemical materials.

The 125 million shares held by Beijing Angzhan, the shareholder of ST Shida, will be auctioned by the judiciary.

() It is announced that 125 million shares of unrestricted shares held by Beijing Anzhan Technology Development Co., Ltd. (Beijing Anzhan), the company’s original shareholder holding more than 5%, will be auctioned, accounting for 80.05% of its shares and 5.73% of the company’s total shares.

Juhua Co., Ltd.: It plans to invest 1.576 billion yuan to build a 150,000-ton/year special polyester chip new material project.

Juhua Co., Ltd. announced on the evening of July 28th that its wholly-owned subsidiary, Ninghua Company, plans to implement a 150,000-ton/year special polyester chip new material project with a total investment of 1.576 billion yuan. It is planned to be completed by the end of October 2024 and put into trial operation at the end of 2024.

Chongqing Construction Engineering Co., Ltd. signed a total of 34.195 billion yuan of new contracts in the first half of the year, an increase of about 5.59% year-on-year

Chongqing Construction Engineering announced that the amount of new contracts signed by the company and its holding subsidiaries in the second quarter of 2022 was 15.457 billion yuan, a decrease of about 18.92% compared with the same period of last year. In the first half of 2022, the cumulative amount of newly signed contracts was 34.195 billion yuan, an increase of about 5.59% over the same period of last year.

Qilu Bank: It is planned to invest 1 billion yuan to initiate the establishment of Qilu Finance.

On July 28th, () announced that the company held the 22nd meeting of the 8th Board of Directors, deliberated and passed the Proposal on Initiating the Establishment of Financial Management Subsidiary, and agreed that Qilu Financial Management Co., Ltd. (the final name shall be subject to the name recognized by the regulatory authorities and approved by the industrial and commercial registration authority) was established with a registered capital of 1 billion yuan, and the registered place is planned to be Jinan City, Shandong, China Province, and the company’s shareholding ratio is 100%.

Qilu Bank said that the source of funds for this investment is the company’s own funds. This investment is an important measure for the company to implement the latest requirements of the regulatory authorities and promote the healthy development of wealth management business, which is conducive to further improving the institutional framework of the company’s wealth management business, strengthening the risk isolation of wealth management business, and better realizing the service purpose of "entrusted by people and managing wealth on behalf of customers". The establishment of a wealth management subsidiary conforms to the regulatory policy orientation and the development trend of domestic and international banking industry, and also conforms to the company’s own strategic development plan, which is conducive to improving the company’s comprehensive financial service level and enhancing its ability to serve the real economy, create value and resist risks as a whole.

Wen Qingnan, shareholder of Ailong Technology, reduced his holdings by 720,000 shares.

Ailong Technology announced that the company recently received the Notice Letter on the Implementation Progress of the Reduction Plan issued by Mr. Wen Qingnan. As of the disclosure date of this announcement, Wen Qingnan has reduced the company’s shares by 720,000 shares, accounting for 0.93% of the company’s total share capital; The time for this reduction plan has been more than half, and the reduction plan has not yet been implemented.

Sanlianban Mingzhi Electric: The revenue of the company’s mobile robot-related business accounts for a relatively low proportion of the total revenue.

On July 28th, the news () announced the change. Recently, the company paid attention to the media associating the company with the hot concepts in the robot-related market. According to the company’s self-inspection, the company’s mobile robot related business mainly involves the main subsidiaries of the company’s control motor and its drive system business segment, and its products are mainly used in logistics warehousing service robots (AGV/AMR), commercial service robots and industrial service robots.

In 2021, the operating income of the company’s mobile robot related business was 103 million yuan, accounting for 3.8% of the company’s operating income; The company’s mobile robot related business revenue accounts for a relatively low proportion of the company’s total operating income, which will not have a significant impact on the company’s current operating performance.

Chongqing Construction Engineering: The amount of new contracts signed in the second quarter decreased by about 18.92% year-on-year.

Chongqing Construction Engineering announced on the evening of July 28th that the amount of new contracts signed by the company and its holding subsidiaries in the second quarter of 2022 was 15.457 billion yuan, a decrease of about 18.92% compared with the same period of last year. In the first half of 2022, the cumulative amount of newly signed contracts was 34.195 billion yuan, an increase of about 5.59% over the same period of last year.

Sanlian Mingzhi Electric said that the income from mobile robot-related business accounts for a relatively low proportion.

On the evening of July 28th, Mingzhi Electric, whose share price rose sharply recently, announced that the revenue of the company’s mobile robot related business accounted for a relatively low proportion in the company’s overall operating income, which would not have a significant impact on the company’s current operating performance.

Mingzhi Electric said that recently, the company was concerned that some media associated the company with the hot concepts in the robot-related market. According to the company’s self-inspection, the company’s mobile robot related business mainly involves the main subsidiaries of the company’s control motor and its drive system business segment, and its products are mainly used in logistics warehousing service robots (AGV/AMR), commercial service robots and industrial service robots. In 2021, the operating income of the company’s mobile robot related business was 103.1341 million yuan, accounting for 3.8% of the company’s operating income; The company’s mobile robot related business revenue accounts for a relatively low proportion of the company’s total operating income, which will not have a significant impact on the company’s current operating performance.

In the secondary market, Mingzhi Electric has closed three daily limit boards in succession. As of the close of July 28th, Mingzhi Electric reported 30.64 yuan/share, with an increase of 10.02%. According to the statistics in the form of post-recovery, the price reached a record high.

Chen Hongling, the actual controller of Baolong Technology, reduced his shareholding by 2%.

() Announcement: On July 28, 2022, the company received a notice from Mr. Chen Hongling, the actual controller of the company. From July 25 to July 27, 2022, Mr. Chen Hongling reduced his holdings of 4.155 million shares of the company through block trading, accounting for 2% of the company’s total share capital.

Xiao Zhiguo, shareholder of Dongwei Technology, reduced his holdings to less than 5%.

Dongwei Technology announced that on July 28th, the company received the Simplified Equity Change Report issued by shareholder Xiao Zhiguo, and during the period from July 26th to July 28th, it reduced its holdings by 780,000 shares, with a reduction ratio of 0.5299%. After this equity change, Xiao Zhiguo holds 7,359,900 shares of the company, accounting for 4.9999% of the company’s total share capital, and is no longer a shareholder holding more than 5% of the company’s shares.

Ruihuatai’s issue of convertible bonds was approved by the China Securities Regulatory Commission for registration.

Ruihuatai announced that the company recently received the "Reply on Approving Shenzhen Ruihuatai Film Technology Co., Ltd. to issue convertible corporate bonds to unspecified objects for registration" issued by China Securities Regulatory Commission. Reply to the company’s registration application for issuing convertible corporate bonds to unspecified objects.

Juhua Co., Ltd.: It plans to invest 1.576 billion yuan to build a 150,000 tons/year special polyester chip new material project.

Southern Finance July 28th, Juhua announced on the evening of July 28th, 2022 that Ningbo Juhua Chemical Technology Co., Ltd., a wholly-owned subsidiary, plans to implement a 150,000-ton/year special polyester chip new material project with a total investment of 1.576 billion yuan. It is planned to be completed by the end of October 2024 and put into trial operation by the end of 2024.

The project has been reviewed and approved by the 20th meeting of the 8th Board of Directors of the Company. It does not need to be reviewed by the shareholders’ meeting of the Company, and the construction can only be started after the relevant government approval is completed. (21st century business herald)

Distribution of rights and interests of Zhongtian Technology in 2021: 0.1 yuan’s equity registration for each share on August 4th.

() Announce the implementation of the company’s annual equity distribution in 2021: based on the company’s total share capital before the implementation of the plan, cash dividends will be distributed per share (including tax) in 0.1 yuan, date of record on August 4, 2022 and ex-dividend date on August 5, 2022.

Jushi Chemical elected Chen Gang as the chairman.

Jushi Chemical announced that the company meeting elected Mr. Chen Gang as the chairman of the sixth board of directors of the company, and his term of office was the same as that of the current board of directors. It is agreed to appoint Mr. Chen Gang as the general manager of the company, and the term of office is the same as that of the current board of directors.

305 million restricted shares of Fangyuan were listed and circulated on August 8.

Fangyuan shares announced that the number of restricted shares in the company’s listing and circulation this time is 305 million shares, and the restricted sale period is 12 months; The listing date is August 8, 2022.

The total shareholding ratio of Zhongzhao Investment, the shareholder of Ginza Co., Ltd. and its concerted parties fell below 5%

() Announcement: On July 28th, the company received the Report on Simple Equity Change of Ginza Group Co., Ltd. issued by Zhongzhao Investment, a shareholder holding more than 5% of the shares. From July 15th to July 28th, Zhongzhao Investment reduced its holding of 22,420,200 shares of the company through centralized bidding, accounting for 4.31% of the company’s total share capital. After the reduction, Zhongzhao Investment and its concerted parties held a total of 26,003,300 shares, accounting for 4.99999896% of the total share capital, and the total shareholding ratio fell below 5%, which will not lead to changes in the controlling shareholder and actual controller of the company.

Yellow River Cyclone: Development technologies such as CVD diamond cultivation and production methods are still in the research and development stage.

() Announced on the evening of July 28th, and replied to the media’s concerns: the project of cultivating diamond industrialization is a key development project in changge city. On July 26th, 2022, the company participated in the observation activities of Xuchang 2022 key project and "three batches" project. On April 7, 2022, the company issued a fixed-income plan, and the total amount of funds raised was not less than 800 million yuan and not more than 1.05 billion yuan, which was mainly used to cultivate diamond industrialization projects. The company has set up a CVD laboratory, which mainly develops diamond application technology. At present, the company’s main method of producing and cultivating diamonds is high temperature and high pressure. The production method of CVD cultivating diamonds and the development technology of the third generation semiconductor are still in the research and development stage, and there are still uncertain factors whether industrialization will be formed in the future.

Yellow River Cyclone Clarification: The manufacturing method of CVD diamond cultivation and the development technology of the third generation semiconductor are still in the research and development stage.

The Yellow River Cyclone issued an announcement. Recently, the company paid attention to the media reports that "the company plans to invest a total of 5 billion yuan to expand production and cultivate diamonds". In order to facilitate investors to know about the company, the company has carefully verified the contents of the report, and now it is clarified.

(1) Report: "The Yellow River cyclone diamond industrialization project is a key development project in changge city, with a total investment of 5 billion yuan, covering an area of 230 mu: 1) It includes three projects: large cavity intelligent press project, intelligent sorting and testing center project and green purification project; 2) To achieve three goals: to extend the industrial chain, to improve innovation chain and to upgrade the value chain. The project is independently developed by the company’s scientific research team, which can effectively reduce the cost of raw materials by more than 50% and save human resources by more than 30%. After all the projects are completed, it is estimated that the annual sales income will be 10 billion yuan. "

The project of cultivating diamond industrialization is a key development project in changge city. On July 26th, 2022, the company participated in the observation activities of Xuchang 2022 key project and "three batches" project. On April 7, 2022, the company issued the Plan for Non-public Offering of Stocks in 2022. The total amount of funds raised was not less than 800 million yuan and not more than 1,050 million yuan, which was mainly used to cultivate diamond industrialization projects, supplement liquidity and repay bank loans.

(II) Report: "The company is stepping up research and development of CVD large single crystals and the development and promotion of third-generation semiconductors".

Relying on the national enterprise technology center and enterprise Post-Doctoral Research Center, the company started the research and development project of cultivated diamonds in 2002, and completed the development and industrialization of high-grade colorless and colored cultivated diamonds above carat level. The manufacturing methods of laboratory cultured diamonds are mainly divided into high temperature and high pressure (HTHP) and chemical vapor deposition (CVD). The company has set up a CVD laboratory, which mainly develops diamond application technology. At present, the company’s main method of producing and cultivating diamonds is high temperature and high pressure. The production method of CVD cultivating diamonds and the development technology of the third generation semiconductor are still in the research and development stage, and there are still uncertain factors whether industrialization will be formed in the future.

Tiandiyuan hired Wang Tao as the president.

() Announced that the board of directors of the company agreed to appoint Mr. Wang Tao as the president of the company and Mr. Liu Yu as the secretary of the board; Nominated by the company’s president, the board of directors agreed to appoint Mr. Liu Yongming as the company’s executive vice president, Mr. Yang Bin, Mr. Zhang Xiaodong, Mr. Yuan Xuegong and Mr. Liu Xiangming as the company’s vice president, and Ms. Yu Ling as the company’s chief financial officer.

Yellow River Cyclone: The manufacturing method of CVD diamond cultivation and the third generation semiconductor development technology are still in the research and development stage.

The Yellow River Cyclone announced that the company was concerned about some media reports that "the company plans to invest a total of 5 billion yuan to expand production and cultivate diamonds". The company has carefully verified the contents of the report, and now it is clarified. The project of cultivating diamond industrialization is a key development project in changge city. On July 26th, 2022, the company participated in the observation activities of Xuchang 2022 key project and "three batches" project. The company has set up a CVD laboratory, which mainly develops diamond application technology. At present, the company’s main method of producing and cultivating diamonds is high temperature and high pressure. The production method of CVD cultivating diamonds and the development technology of the third generation semiconductor are still in the research and development stage, and there are still uncertain factors whether industrialization will be formed in the future.

Ruikeda has received a total of 20,945,600 yuan of government subsidies related to income.

Ruikeda issued an announcement. As of July 28, 2022, the company and its subsidiaries had received a total of 20,945,600 yuan of government subsidies related to income. It is expected to have a certain impact on the company’s 2022 annual profit.

Magic Investment, the controlling shareholder of Magic Pharmaceutical, has reduced its holdings by 10.64 million shares.

() Announcement was issued. On July 28, 2022, the company received a notice from Guizhou Magic Investment Co., Ltd. ("Magic Investment"), the controlling shareholder of the company. From July 18, 2022 to July 28, 2022, it reduced its A shares by 10.64 million shares through block trading, accounting for 1.99% of the company’s total share capital.

Huayang Co., Ltd.: The main equipment of the battery project involved in the company’s sodium ion battery has been installed and the project has not yet been put into production.

() On the evening of July 28th, the announcement of stock trading changes was disclosed. Recently, the company found that there were industry reports and discussions related to sodium ion batteries. Based on the principle of prudence, the progress of related projects of the company is now described as follows: As of the disclosure date of this announcement, the main equipment of the battery project involved in the company’s sodium ion batteries has been installed, but the commissioning has not been completed, and the project has not yet been put into production, which has not yet generated any income.

Ding Huande, Chairman of huadian power international, resigned due to his age.

Today, huadian power international announced the resignation of the chairman. Huadian power international said that the company has received the resignation report of Chairman and Director Ding Huande today. Due to his age, Ding Huande applied to resign as the chairman, director and chairman of the strategy committee of the ninth board of directors of the company. Ding Huande’s resignation application will take effect after the company’s general meeting of shareholders elects a new director.

Huadian power international’s annual report for 2021 shows that Ding Huande, born in August 1962 in China, is a senior engineer. He graduated from North China Electric Power University with a master’s degree in engineering. He is currently the chairman of the company and an assistant to the general manager of China Huadian Group Co., Ltd. Ding Huande has worked in Huangdao Power Plant, Qingdao Power Plant, Linyi Power Generation Co., Ltd., Shandong International Power Development Co., Ltd., Huadian Fuel Co., Ltd. and Huadian Coal Industry Group Co., Ltd. Ding Huande has more than 30 years of working experience in power production, dispatching and fuel management.

AVIC Shen Fei: Qi Xia resigned as chief accountant and secretary of the board of directors.

() Announced that the board of directors of the company recently received a written resignation report from Mr. Qi Xia. Mr. Qi Xia resigned as a director, member of the audit committee of the board of directors, chief accountant and secretary of the board of directors due to job changes.

According to the Listing Rules of Shanghai Stock Exchange and other relevant regulations, after deliberation and approval at the 16th meeting of the ninth board of directors of the company, Xue Hongyu, deputy general manager, was appointed to perform the duties of chief accountant and secretary of the board of directors on his behalf during the period when the company did not formally hire a new chief accountant and secretary of the board.

(): Sipuleucel-T injection phase III key registered clinical trial will be launched in the near future.

Nanjing Xinbai announced on the evening of July 28th that Shanghai Than Shwe, a holding subsidiary, will start the phase III key registered clinical trial of Sipuleucel-T injection in the near future.

Yinhe Microelectronics: "Yinwei Convertible Bonds" will be listed and traded on August 2nd.

Galaxy Micro-Power announced that the company’s 500 million yuan convertible corporate bonds will be listed and traded on the Shanghai Stock Exchange from August 2, with the bond code "118011".

Shareholders of Heli Technology intend to reduce their holdings by no more than 3%.

Heli Technology announced that Daixi Investment, a shareholder holding 6% of the shares, plans to reduce its holdings by no more than 4.704 million shares in the company within 6 months, and no more than 3% of the company’s total share capital.

Jianyou shares: obtained the registration approval of vancomycin hydrochloride for injection from FDA.

Jianyou Co., Ltd. announced on the evening of July 28 that the company was notified by the US FDA on July 27, and the ANDA application for vancomycin hydrochloride for injection, 5g/ bottle and 10g/ bottle declared by the company to the US FDA was approved.

Jianyou shares obtained the registration approval of vancomycin hydrochloride for injection from FDA.

Jianyou Co., Ltd. announced that the company recently received an approval letter from the US Food and Drug Administration (hereinafter referred to as "FDA") for vancomycin hydrochloride for injection, 5g/ bottle and 10g/ bottle (ANDANo.: 215196).

Jinguan Electric Consortium won the bid for 159 million yuan charging station construction project.

Jinguan Electric issued an announcement. On July 26th, 2022, Fangcheng County Public Resource Trading Center issued the Announcement on the Results of Fangcheng County Electric Vehicle Public Charging Station (Pile) Infrastructure Construction Project. The consortium composed of Henan Jinguan Electric Power Engineering Co., Ltd. (hereinafter referred to as "Jinguan Electric Power") and Nanyang Jinguan Intelligent Switch Co., Ltd. (hereinafter referred to as "Intelligent Switch") won the bid in the first bid section of this project, with the winning amount of 1.59.

Guo Dun Quantum plans to invest 4 million yuan to establish a joint venture company.

Guo Dun Quantum announced that in response to the establishment of the Silicon Valley Platform Service Company of HKUST, the company plans to use its own funds to jointly invest with companies such as (), (), Benquan Quantum and Guoyi Quantum to establish a joint venture company. The name of the joint venture company is "HKUST Silicon Valley Service Platform Co., Ltd." (subject to the approval of the industrial and commercial department), with a registered capital of 100 million yuan, of which the registered capital of the company is 4 million yuan in cash, holding 4% of the shares.

Neusoft Group sends 0.6 yuan date of record for every 10 shares on August 3rd.

() It is announced that the company will distribute the annual rights and interests in 2021, and distribute the cash dividend (including tax) for every 10 shares in 0.6 yuan and date of record on August 3rd.

Fengfan shares: polycrystalline silicon accounts for more than 50% in the structure of Jingying photoelectric products.

() On the evening of July 28th, the announcement of stock trading changes was disclosed. At present, in the product structure of Jingying Optoelectronics, polysilicon accounts for more than 50%. At present, the development of photovoltaic industry takes monocrystalline silicon and high-purity silicon as the mainstream direction, and the market of polysilicon and its related products may be gradually compressed or even eliminated. If this trend continues further, the operation of Jingying Optoelectronics will face greater challenges. There are certain uncertainties about whether and when the acquisition of 100% equity of Jingying Optoelectronics can be approved.

Lujiazui: Elected Xu Erjin as the chairman of the company.

Southern Finance On July 28th, Shanghai Lujiazui Financial and Trade Zone Development Co., Ltd. announced that the board of directors of the company agreed to elect Mr. Xu Erjin as the chairman of the ninth board of directors of the company and act as the general manager of the company. Li Jinzhao, the former chairman of the board of directors, resigned as chairman, director, legal representative, acting general manager and special committee of the board of directors due to retirement, and Li Jinzhao will no longer hold any other positions in the company after his retirement. (21st century business herald)

Fengfan shares recorded three consecutive boards, and there is uncertainty in acquiring 100% equity of Jingying Optoelectronics.

Fengfan Co., Ltd. announced that the closing price of the company’s shares deviated by more than 20% in three consecutive trading days on July 26, July 27 and July 28, 2022. According to the relevant provisions of the Trading Rules of Shanghai Stock Exchange, it belongs to the abnormal fluctuation of stock trading prices.

Risks related to this asset acquisition: At present, in the product structure of Suzhou Jingying Optoelectronics Technology Co., Ltd. (hereinafter referred to as "Jingying Optoelectronics"), polysilicon accounts for more than 50%. At present, the development of photovoltaic industry is dominated by monocrystalline silicon and high-purity silicon, and the market of polysilicon and its related products may be gradually compressed or even eliminated. If this trend continues further, the operation of Jingying Optoelectronics will face greater challenges.

Whether and when the acquisition of 100% equity of Jingying Optoelectronics (hereinafter referred to as "this transaction") can obtain relevant approval or approval is uncertain. Therefore, there are certain risks in whether this transaction can finally be successfully implemented.

Wanhua Chemical: Lower MDI price in China in August.

() On the evening of July 28th, it was announced that since August 2022, the listed price of polymeric MDI in China area of the company was 18,500 yuan/ton (down 1,300 yuan/ton from July); The listing price of pure MDI is 22,300 yuan/ton (1,500 yuan/ton lower than that in July).

Keda Manufacturing: Signing Global Strategic Cooperation Framework Agreement with Shenzhen Venture Capital

() On the evening of July 28th, it was announced that the company and Shenzhen Venture Capital had reached a preliminary consensus on the strategic cooperative relationship of industrial investment and venture capital in high-end equipment manufacturing, new energy, new materials and other fields around the world. Based on the willingness to cooperate, the two sides signed the Global Strategic Cooperation Framework Agreement on July 28th.

Keda Manufacturing: GDR is issued and listed on the Swiss Stock Exchange.

KEDA Manufacturing announced that the Depositary Receipt ("GDR") issued by the company was listed on the Swiss Stock Exchange on July 28, 2022 (Swiss time). The full name of the securities is Keda Industrial Group Co.,Ltd, and the listing code of GDR is Keda. The GDR issued this time totals 12 million shares, corresponding to 60 million A shares of the company.

Nanwei Software: disclosed the progress of planning control change and continued to suspend trading.

() It is announced that Mr. Wu Zhixiong, the actual controller of the company, is planning to change the company’s control rights. During the suspension period, the parties to the transaction conducted further communication and consultation on the change of the controlling shareholder and actual controller. At present, the relevant transaction agreement has been basically confirmed, and the parties to the transaction are still performing internal review procedures. The company’s stock will continue to be suspended from the market opening on the morning of July 29th, and it is estimated that the suspension time will not exceed 3 trading days. After the above matters are confirmed, the company will issue relevant announcements in time and apply for resumption of trading.

Huiwen Tianfu, a shareholder of Jiulian Technology, has reduced its shareholding by 1.02%.

Jiulian Technology announced that the company today received a letter of reduction from the shareholder Huiwen Tianfu (Suzhou) Investment Enterprise (Limited Partnership) ("Huiwen Tianfu"). As of July 28, 2022, Huiwen Tianfu had reduced its shareholding by 5,113,900 shares through centralized bidding and block trading, accounting for 1.0227% of the company’s total share capital.

Huahai Qingke received a government subsidy of 41.4746 million yuan.

Huahai Zero2IPO announced that from January 1, 2022 to July 28, 2022, the company received a total of 41,474,600 yuan in government subsidies.

Jinguan Electric: A consortium of subsidiaries won the bid for a project of 159 million yuan.

Jinguan Electric announced on the evening of July 28th that the consortium formed by Nanyang Jinguan Intelligent Switch, a wholly-owned subsidiary, won the bid for the infrastructure construction project of Fangcheng county electric vehicle public charging station (pile), with the winning bid amount of 159 million yuan (including tax). It is estimated that the final contract income of this project will be 100 million yuan (including tax). The contract price of the above-mentioned projects accounts for 16.64% of the company’s operating income in 2021.

() The subsidiary won the bid of 52,001,600 yuan for the decoration project of public areas and underground garages in the north plot of Nanhu Tianzhu Phase II.

Jianghe Group announced that Beijing Gangyuan Building Decoration Engineering Co., Ltd. (hereinafter referred to as "Gangyuan Decoration"), a holding subsidiary of the company, recently won the bid for the decoration project of public areas and underground garages in the second phase of Nanhu Tianzhu Real Estate Co., Ltd. (hereinafter referred to as "Nanhu Tianzhu") through public bidding, with the winning bid amount of 52,016,000 yuan, accounting for about 0.25% of the company’s annual operating income in 2021. The project is located in Yueyang City, and the estimated construction period is 180 days.

It is known that Rixin shareholders Shi Yue He ‘an and October Wu Xun intend to reduce their holdings by no more than 2%.

It is known that Rixin announced that due to shareholders’ own capital needs, shareholders Shi Yuehe He ‘an and October Wu Xun plan to reduce their holdings by a total of no more than 1,097,300 shares (that is, no more than 2% of the total share capital of listed companies) through centralized bidding and block trading. The shareholding reduction plan will be carried out within 3 months after 3 trading days from the date of announcement.

Gemdale: The subsidiary plans to purchase corporate bonds of no more than 1 billion yuan in the first phase of marketization.

() On the evening of July 28th, it was announced that Shenzhen Jindi Building Materials Co., Ltd., a subsidiary of the company, would purchase the company’s bonds in the secondary market in a market-oriented way in accordance with the trading rules of the exchange, with the initial scale not exceeding RMB 1 billion.

Gemdale: The company’s directors and core management personnel intend to purchase corporate bonds of no more than 20 million yuan.

Buy the surviving bonds of the company in the secondary market in a market-oriented way.

On July 28th, gemdale issued an announcement on the results of the company’s directors and core management personnel buying corporate bonds in the market and continuing to buy corporate bonds in the market.

According to the announcement, on March 26th, 2022, gemdale issued the Announcement on Market Purchase of Corporate Bonds by Directors and Core Managers of the Company. Ling Ke, Chairman of the Board of Directors of the Company, and some core management personnel will purchase the Company’s bonds in the secondary market in a market-oriented manner in accordance with the trading rules of the Exchange, with the total purchase scale not exceeding RMB 20 million.

As of the date of this announcement, Ling Ke, Chairman of gemdale, and some core management personnel have purchased corporate bonds of "18 Jindi 01", "18 Jindi 07", "21 Jindi 01", "21 Jindi 03" and "21 Jindi 04", with a total purchase amount of 20 million yuan. This bond transaction is consistent with the announced purchase arrangement and meets the requirements of relevant laws and regulations, and there are no behaviors such as interest transfer, violation of fair competition or disruption of market order.

According to the announcement, in order to actively maintain the stability of corporate bond prices and effectively protect the interests of investors, Ling Ke, Chairman of gemdale, and some core management personnel will purchase the company’s existing bonds in the secondary market in a market-oriented way according to the trading rules of the exchange after the announcement is issued, with a total scale of no more than RMB 20 million.

ST Jinggu plans to acquire 51% equity of Huiyin Wood Industry.

() Announced that the company is planning to acquire 51% equity of Tangxian Huiyin Wood Co., Ltd. (hereinafter referred to as Huiyin Wood) held by Cui Huijun and Wang Lancun in cash. Huiyin Wood’s main business is the manufacture and sales of medium and high density fiberboard and particleboard. After the completion of this transaction, the target company will become a holding subsidiary of the listed company.

Juhua Co., Ltd. plans to implement 150,000 tons/year special polyester chip new material project.

Juhua shares announced that Ninghua Company, a wholly-owned subsidiary, plans to implement a 150,000-ton/year special polyester chip new material project with a total investment of 1.576 billion yuan.

Fangyuan shares: About 305 million restricted shares will be lifted on August 8, accounting for 59.65% of the company’s total share capital.

Released on July 28th-Fangyuan shares announced that about 305 million shares of the company’s restricted shares will be released and listed for circulation on August 8th, 2022, accounting for about 59.65% of the company’s total share capital.

Huitong Group: The application for public offering of convertible bonds was accepted by CSRC.

Announcement on July 28th-() said that the company recently received the "China Securities Regulatory Commission Administrative License Application Acceptance Form" issued by China Securities Regulatory Commission (acceptance serial number: 221762). China Securities Regulatory Commission examined the application materials for administrative license for public offering of convertible corporate bonds submitted by the company according to law, and decided to accept the application for administrative license.

Rong Zhixin: Shareholders intend to reduce their holdings by no more than 2% in total.

It is known that Rixin announced on the evening of July 28th that due to the capital needs of shareholders, Shiyue He ‘an and October Wu Xun plan to reduce their holdings by no more than 1,097,300 shares (that is, no more than 2% of the total share capital of listed companies) through centralized bidding and block trading.

Wanhua Chemical’s listing price of polymeric MDI in China in August was 18,500 yuan/ton.

Wanhua Chemical announced that since August 2022, the listing price of polymeric MDI in China of Wanhua Chemical Group Co., Ltd. was 18,500 yuan/ton (down 1,300 yuan/ton from July); The listing price of pure MDI is 22,300 yuan/ton (1,500 yuan/ton lower than that in July).

Keda Manufacturing and Shenzhen Venture Capital signed a global strategic cooperation framework agreement.

Keda Manufacturing announced that the company and Shenzhen Innovation Investment Group Co., Ltd. (hereinafter referred to as "Shenzhen Venture Capital") initially reached a consensus on the strategic cooperation relationship of industrial investment and venture capital in high-end equipment manufacturing, new energy, new materials and other fields around the world. Based on the willingness to cooperate, the two parties signed the Global Strategic Cooperation Framework Agreement on July 28, 2022.

ST Jinggu plans to acquire 51% equity of Huiyin Wood Industry.

On the evening of July 28th, ST Jinggu announced that the company was planning to acquire a total of 51% equity of Tangxian Huiyin Wood Co., Ltd. (hereinafter referred to as Huiyin Wood) held by Cui Huijun and Wang Lancun in cash.

The announcement shows that Huiyin Wood’s main business is the manufacture and sales of medium and high density fiberboard and particleboard. After the completion of this transaction, the target company will become a holding subsidiary of ST Jinggu.

ST Jinggu said that since the matter is still in the preliminary planning stage, there are still uncertainties in the follow-up, and it is possible to adjust or increase the counterparty according to the negotiation. If this transaction is successfully implemented, it will help the company focus on its main business, enhance its business scale and industry position, further enhance its comprehensive competitiveness and enhance its sustainable profitability.

It is known that the two shareholders of Rixin intend to reduce their shareholding in the company by no more than 2%.

On the evening of July 28th, Rongzhi Rixin announced that the shareholders of the company, Lu ‘an Shiyue He ‘an Phase II Venture Capital Partnership (Limited Partnership) (hereinafter referred to as Shiyue He ‘an) and Ningbo October Wu Xun Equity Investment Partnership (Limited Partnership) (hereinafter referred to as October Wu Xun), planned to reduce their holdings of the company by no more than 1,097,300 shares, accounting for no more than 2% of the company’s total share capital.

Among them, Shiyue He ‘an and October Wu Xun hold 1,797,500 shares and 719,000 shares of Rongzhixin respectively, which are enterprises under the control of the same actual controller, forming a concerted action relationship, holding a total of 2,516,500 shares, accounting for 4.59% of the company’s total share capital.

For the purpose of reduction, Rong Zhixin said that it is the shareholders’ own capital demand.

Huayang Co., Ltd.: The main equipment of the battery project involved in sodium ion battery has not been debugged yet.

Huayang shares issued a stock trading announcement. As of the disclosure date of this announcement, the main equipment of the battery project involved in the company’s sodium ion battery has been installed, but the commissioning has not been completed, and the project has not yet been put into production, which has not yet generated any income.

Soochow securities: 2 billion yuan short-term financing bonds have been redeemed.

After the close of trading on July 28th, soochow securities announced that on February 23rd, 2022, the company successfully issued the second phase of short-term financing bonds in 2022, with a total amount of 2 billion yuan, 2.45% in coupon rate and a term of 154 days. On July 27th, the company paid the principal and interest of short-term financing bonds in this period, totaling about 2.021 billion yuan.

Nanjing Securities will send 1 yuan and date of record for every 10 shares in 2021 on August 3rd.

Straight Flush Financial News () announced that the company’s annual equity distribution implementation plan for 2021 is as follows: based on the total share capital of 3,686,361,000 shares, a cash dividend of RMB 1.00 yuan will be distributed to all shareholders for every 10 shares, and a total cash dividend of RMB 369 million will be distributed, accounting for 37.72% of the net profit attributable to the mother in the same period. No bonus shares will be distributed, and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is August 3rd, and the ex-dividend date is August 4th.

According to the 2021 annual performance report released by Nanjing Securities, the company’s operating income was 2.742 billion yuan, a year-on-year increase of 15.91%; The net profit attributable to shareholders of listed companies was 977 million yuan, a year-on-year increase of 20.71%; The basic earnings per share was 0.27 yuan, compared with 0.24 yuan in the same period last year.

The main business of Nanjing Securities Co., Ltd. is securities brokerage, proprietary investment, investment banking, asset management, futures brokerage, private equity fund management and alternative investment. The company’s main products are brokerage business, credit trading business, securities investment business, investment banking business, asset management business and futures brokerage business.

(Source: Straight Flush iFinD)

Guandian Defense will send 0.50 yuan for every 10 shares to 3 shares in 2021, and date of record will be August 3.

Straight Flush Financial News Guandian Defence announced that the implementation plan of the company’s annual equity distribution in 2021 is as follows: based on the total share capital of 237.51 million shares, a cash dividend of 0.50 yuan will be distributed to all shareholders for every 10 shares, with a total cash dividend of 11.8755 million yuan, accounting for 16.43% of the net profit attributable to the mother in the same period, and 3.00 shares will be transferred to all shareholders for every 10 shares with capital reserve fund, and no bonus will be distributed.

The distribution of rights and interests in date of record is August 3rd, and the ex-dividend date is August 4th.

According to the 2021 annual performance report released by Guandian Defense, the company’s operating income was 230 million yuan, a year-on-year increase of 27.87%; The net profit attributable to shareholders of listed companies was 72.2879 million yuan, a year-on-year increase of 35.22%; The basic earnings per share was 0.30 yuan, compared with 0.40 yuan in the same period last year.

Guandian Defense Technology Co., Ltd. is a state-level specialized and innovative "little giant" and high-tech enterprise. It is the leading domestic drone anti-drug service provider and the earliest domestic enterprise engaged in drone anti-drug product research and development and service industrialization. The company’s main business is UAV flight service and data processing, and the R&D, production and sales of UAV systems and intelligent defense equipment. In terms of UAV flight service and data processing, the company provides customers with full-chain solutions such as project planning, data acquisition, data interpretation, supervision and verification, intelligence research and judgment, relying on its own database and professional processing technology with independent intellectual property rights accumulated over the past ten years. The company’s business covers drug control, anti-terrorism, resource investigation, environmental monitoring, emergency rescue and other fields, especially in the field of drug control, and related scientific research projects have won the second prize of science and technology issued by the Ministry of Public Security.

(Source: Straight Flush iFinD)

Zhongtian Technology will send 1 yuan date of record for every 10 shares in 2021 as August 4th.

Straight Flush Financial News Zhongtian Technology announced that the implementation plan of the company’s annual equity distribution in 2021 is as follows: based on the total share capital of 3,412,949,700 shares, a cash dividend of RMB 1.00 will be distributed to all shareholders for every 10 shares, with a total cash dividend of RMB 341 million, accounting for 198.32% of the net profit attributable to the mother in the same period. No bonus shares will be distributed and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is August 4th, and the ex-dividend date is August 5th.

According to the 2021 annual performance report released by Zhongtian Technology, the company’s operating income was 46.163 billion yuan, a year-on-year increase of 9.7%; The net profit attributable to shareholders of listed companies was 172 million yuan, a year-on-year decrease of 92.43%; The basic earnings per share was 0.06 yuan, compared with 0.75 yuan in the same period last year.

Jiangsu Zhongtian Technology Co., Ltd. is a professional enterprise with the most complete variety of optical cables in China, mainly engaged in optical fiber communication and power transmission. Its main products include optical communication and network, power transmission, ocean series, new energy, copper products and commodity trade.

"Three-core ultra-high voltage cross-linked polyethylene insulated optical fiber composite submarine cable" won the first prize of national equipment management innovation achievement award in power industry. "Metal-free self-supporting optical cable", "OPGW" and "leaky coaxial cable" won the title of "single champion product of manufacturing industry" by the Ministry of Industry and Information Technology; Zhongtian Technology Submarine Cable Co., Ltd. was awarded the "Single Champion Cultivation Enterprise of Manufacturing Industry" by the Ministry of Industry and Information Technology.

(Source: Straight Flush iFinD)

Zhongtai Securities will pay 0.63 yuan for every 10 shares in 2021, and date of record will be August 3.

Straight Flush Financial News () announced that the company’s annual equity distribution implementation plan for 2021 is as follows: based on the total share capital of 6,968,625,800 shares, a cash dividend of 0.63 yuan will be distributed to all shareholders for every 10 shares, and a total cash dividend of 439 million yuan will be distributed, accounting for 13.72% of the net profit attributable to the mother in the same period. No bonus shares will be distributed, and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is August 3rd, and the ex-dividend date is August 4th.

According to the 2021 annual performance report released by Zhongtai Securities, the company’s operating income was 13.15 billion yuan, a year-on-year increase of 27.02%; The net profit attributable to shareholders of listed companies was 3.200 billion yuan, a year-on-year increase of 26.72%; The basic earnings per share was 0.46 yuan, compared with 0.36 yuan in the same period last year.

The main business of Zhongtai Securities Co., Ltd. mainly includes wealth management business, investment banking business, securities proprietary business, credit business, research business, asset management business, futures business, private investment fund business, alternative investment business and overseas business including Hong Kong market. At the same time, through its holding subsidiaries, Zhongtai Asset Management, Luzheng Futures, Zhongtai Capital, Zhongtai Venture Capital and Zhongtai International, the Company is engaged in asset management business, futures business, private equity fund business, alternative investment business and overseas business including Hong Kong market. In 2019, the company won the 95538 call center awarded by the All-China Federation of Trade Unions and the title of "National Worker Pioneer" awarded by the All-China Federation of Trade Unions; In the "Junding Award for 2019 China Investment Bank" sponsored by Securities Times, the company won the "Junding Award for 2019 China New Investment Bank". In 2016, the company was selected by China Internet News Center as "2015 China New Third Board Top Ten Market Maker Award"; The company was selected by Securities Times as the "Recommended Team for the Best Stock Transfer System Listing in China in 2016", and the company was awarded the "The Most Influential Listed Broker of the New Third Board" by China Business News.

(Source: Straight Flush iFinD)

City Investment Holdings will pay 1.10 yuan for every 10 shares in 2021, and date of record will be August 4.

Straight Flush Financial News () announced that the company’s 2021 annual equity distribution implementation plan is as follows: based on the total share capital of 2,529,575,600 shares, a cash dividend of RMB 1.10 will be distributed to all shareholders for every 10 shares, and a total cash dividend of RMB 278 million will be distributed, accounting for 30.53% of the net profit attributable to the mother in the same period. No bonus shares will be distributed, and no capital reserve will be converted into share capital.

The distribution of rights and interests in date of record is August 4th, and the ex-dividend date is August 5th.

According to the 2021 annual performance report released by Chengtou Holdings, the company’s operating income was 9.193 billion yuan, a year-on-year increase of 40.03%; The net profit attributable to shareholders of listed companies was 912 million yuan, a year-on-year increase of 18.26%; The basic earnings per share was 0.36 yuan, compared with 0.30 yuan in the same period last year.

The main business of Shanghai Chengtou Holding Co., Ltd. is characteristic development, intelligent operation and real estate finance, forming a sustainable business chain and ecological circle. Business and services cover commercial housing, rental housing, affordable housing, development of science and technology parks, renovation of old urban areas, renovation of villages in cities and PPP projects, operation of rental housing, investment and disposal of real estate, property management, direct equity investment and private equity investment fund management.

(Source: Straight Flush iFinD)

Chongqing Construction: The amount of newly signed contracts in the first half of the year was 34.195 billion yuan, up 5.59% year-on-year.