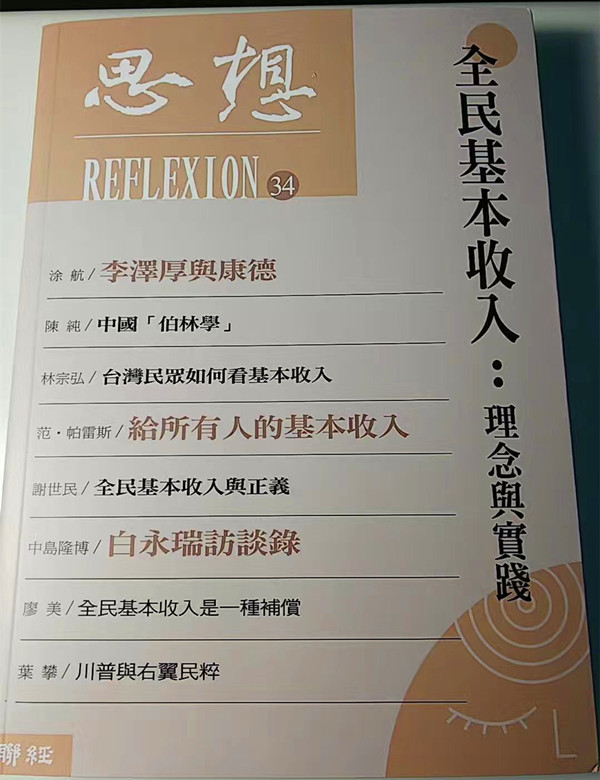

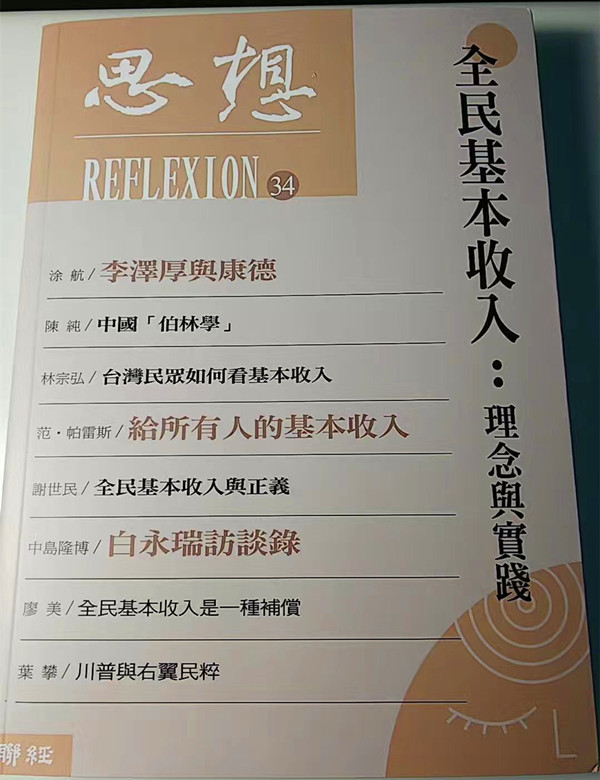

[Editor’s Note] This interview was conducted in Seoul on August 24th, 2015. The interviewer was Professor Takahiro Nakajima of the Center for Philosophy Research of the University of Tokyo, Japan, and the interviewee was Professor Bai Yongrui of Yonsei University, South Korea, with Jin Hang as the translator. The original title of this article is "Giving Vitality to the Gap: An Interview with Bai Yongrui", which was signed by the author as "Conversation between Nakajima Takabo and Lu Chan" and published in Thought magazine (published by Lianjing Publishing Company on December 14, 2017). Reprinted by The Paper with authorization. The original interview was 20,000 words long, and here are some excerpts. There are notes in the original text, which are omitted here.

I. Born in Incheon shortly after the signing of the Korean Armistice Agreement.

Nakajima Takahiro:When planning this dialogue, two texts came to my mind. One is a dialogue between Emmanuel Lévinas and Philip Nemo. This was originally an interview in a radio program, and later it was compiled into a book called Ethics and Infinity. This book is very good. Levinas talks about his philosophy in it, and there are some things that he may not put into writing. On the question "What kind of philosophy is Levinas’ philosophy?", he expounded it in his own words, which is very simple and easy to understand. I want to use this as a model to talk to you today. The dialogue between Levinas and Nemo began with the former’s childhood memories, and another text that came to my mind happened to be walter benjamin’s Childhood in Berlin around 1900. Today, I want to start a dialogue with these two texts as examples. First of all, please ask Professor Bai to recall his childhood and let everyone know the story of Bai Yongrui (= history).

Benjamin said in the book: "The picture of my urban childhood may be able to shape the future historical experience in advance." He listed his unique historical view and some corresponding childhood impressions. Excuse me, what is Professor Bai’s impression of his childhood?

Bai Yongrui:First of all, I would like to thank Professor Nakajima for coming to Seoul. Among the questions received in advance, it was written that "personal issues do not involve privacy issues". I think you indicated this article with reference to Benjamin and Levinas. This inspired me and looked back on my childhood.

First of all, I want to emphasize one point. I was born in August 1953, shortly after the signing of the Korean Armistice Agreement (July 1953). My parents were born in Huanghai Road, North Korea, and moved to the south across the 38th parallel, which is called "Vietnam" in Korean, so my parents are both "Vietnamese citizens". This kind of birth and experience formed my first impression of childhood.

Incheon, like Yokohama in Japan, is also a seaport city that opened to the outside world very early. I was born in the slums of this city. Although he was born in a slum, he was not a poor family. My father is a primary school teacher, so our family is a rich class in the slums. I have been very sensitive to the "difference" between the poverty around me and my living conditions since I was a child. I am not only insensitive to the gap between the rich and the poor around me and the differences between myself, but also worried about poverty and the gap between the rich and the poor although I was a child.

My sensitivity to the gap between the rich and the poor probably stems from two influences. One is Christianity. My mother is a Christian. Under her influence, I learned to understand and face the gap between the rich and the poor. The other is family reasons, and parents are not in harmony. As a "Vietnamese citizen", there are often disputes at home. Mothers are sometimes treated violently by their fathers, which is a domestic violence. I have been thinking about "why do we live in such a violent environment" since a long time ago, and I feel the same for my mother. Because of this experience, I have a certain feminine sensibility inside. In short, one is the influence of Christianity; The second is thinking about the abused vulnerable groups such as women, that is, the minority groups in society. Since then, I have developed a perceptual knowledge of the weak and the poor in my body.

When I was young, I spent more time reading and writing at home than playing with my friends next door. Later, these became my interests and I spent most of my time on books. Maybe I have a little talent. My composition often wins prizes after school. In junior high school and senior high school, I participated in literary and art activity groups. When I was in college, I wanted to study literature, especially Chinese literature. However, they are opposed by their parents. They think that "learning literature and being poor all their lives" should be studied in law or philosophy. Finally, I made a compromise and chose history.

Tsukagoshi Hirotaka Nakajima:Recently, I just read Xian Xixian’s Till Death, and found that Christianity had an extremely important influence in South Korea in the second half of the 20th century. As a Christian, your mother should often be exposed to poverty.

Bai Yongrui:Christianity has played many roles in Korea. Especially in improving the status of women, this has become a religious and social phenomenon. After being hurt by her father, my mother may have found solace in the church. Until now, the church still has the function of spiritual healing. From the perspective of Christianity improving women’s status, my mother has no formal education, but learned Korean and parenting knowledge in church, and was exposed to society and culture.

My mother was deeply influenced by the church, and I was deeply influenced by my mother. However, in the process of my growth, this influence has become a huge burden in terms of emotion and sensibility. Give an impressive example. In my junior year, I was arrested and imprisoned for participating in the student movement. It was a winter, and when I thought that my son was in prison for the winter, my mother didn’t use the heating all winter. This is "maternal love and burden go hand in hand". In addition, through the communication with the parents of those students’ sports companions, the mother also joined the democratization movement. Under the influence of Christian spirit, the mother gradually regarded the love for her son and the democratization movement as one. I witnessed the changes in my mother with my own eyes and was surprised that a person could change like this. This is a very deep impression on my mother.

Tsukagoshi Hirotaka Nakajima:I once asked the Koreans in Japan and South Korea. It is said that the problem of domestic violence among Koreans in Japan and South Korea was once very serious. Later some young people criticized this. Those who were familiar with the situation at that time could not give a reasonable explanation even if they were condemned. Of course, the same problem exists in Japanese society, and many families have experienced violence. From this, I thought that those war wounds that are everywhere may be vented in the form of "domestic violence". This is not only a matter of Professor Bai’s family, but also a common problem in East Asia.

If you are not afraid of misunderstanding, isn’t it because of the influence of childhood environment that Professor Bai has paid attention to minority groups? However, unlike you, more people choose to solve the problem through male or paternalistic violence.

I think that "minorities" are often associated with some kind of "fairness = fairness". Professor Bai once wrote that the antonym of forgetting is not memory but justice. That’s true. But besides "justice", I deeply feel that there is fairness in it. After listening to Professor Bai’s words just now, I think it is precisely because of your childhood impression of your mother.

Bai Yongrui:As Professor Nakajima said, the transformation of war trauma into domestic violence is not only a problem for our family, but also a common phenomenon throughout East Asia. We abandoned our wealth and took refuge from the Yellow Sea Road in North Korea. As "Vietnamese citizens", our lives were hard. Trauma is manifested as the violence of interpersonal relationship.

I witnessed my mother’s misfortune, and thus I became concerned about the minority. This is concern for the mother or the weak. But at the same time, there is also an important reason for his father’s misfortune, or that his life should be like this. The concern for minorities or feminism is not limited to the concern for the weak, but also the concern for interpersonal relationships and people themselves. In violent relationships, people themselves are devastated. I have a deep understanding of this since I was a child.

Looking back on the past, men in adolescence will have the illusion and desire to show their masculinity. But I am small, even if I want to be such a man, it is unrealistic. Because of this, I began to think about my body. This may be an opportunity for me to understand women later. Recently, I began to use the expression "female element in myself". Childhood memories leave not only rational perception, but also physical memory.

Tsukagoshi Hirotaka Nakajima:In Professor Bai’s thesis, there have been many expressions about body feeling. But this kind of physical feeling keeps a certain distance from the thought, which is impressive. Although the dialogue will be mentioned again later, now I want to say that the part based on physical feeling is an important element in the "universality" that Professor Bai thinks about. It seems that there has always been a strong physical feeling in your article.

Bai Yongrui:Thank you, Professor Nakajima, for reading my article. But as far as I’m concerned, I didn’t realize that I would resort to words for my physical feelings. It should be said that this is my future topic.

Professor Bai Yongrui

Second, the crisis of reading life and peace

Tsukagoshi Hirotaka Nakajima:Next, let’s change the topic. Please ask Professor Bai to talk about his childhood study life. Levinas mentioned in his dialogue with Nemo that he read Russian literature when he was a child. Levinas said that although he did not need to regard himself as a Russian national, he still read Russian literature. What books did you read when you were a child?

Bai Yongrui:When I was in primary school, I read the world famous books published for boys and girls. After entering middle school, I read the complete works of world literature. But I didn’t limit myself to reading a certain country’s literary works like Levinas did.

Tsukagoshi Hirotaka Nakajima:Are there any works that are particularly impressive?

Bai Yongrui:What impressed me most was a reading experience in Grade Two or Grade Three. Living in a slum, only the priest can study together. We read History and Eschatology by Rudolf Karl Bultmann. This is a book about theology. After reading it, I became interested in such questions as "What is the power to push history forward", "Some law to control history" and "What is faith". Just now, I said that my choice of history was the result of compromise with my parents. To tell the truth, I didn’t really accept it myself, but in retrospect, maybe it has something to do with that reading experience.

At that time, the history department of Seoul National University was divided into Korean history, oriental history and western history. I chose Oriental History without hesitation. One of the reasons is that I am very interested in how Bultmann’s historical philosophy, historical laws and historical forces reflect these problems in East Asia.

Another reason is the situation at that time. In 1971, Sino-US relations began to ease. The relaxation policy is spreading, and people’s attention to China is increasing. Influenced by this, I chose Oriental History.

Tsukagoshi Hirotaka Nakajima:I think many people have had this experience, and in the process of growing up, there was some kind of identity crisis. Some people have survived this crisis, while others have not. What kind of junior and senior high school life did Professor Bai experience before he went to college? Is it calm or full of crisis?

Bai Yongrui:I have hardly experienced an identity crisis (laughs). My junior high school and senior high school are famous local schools, and I have been the president of the student union, and the activities of the literary and art activity group are also very smooth. It can be said that as a good student, I live a model life.

However, I experienced a big crisis in my freshman year. At that time, the principal graduated from Hiroshima Normal School and was an anarchist comparable to Xian Xixian. He insisted on his own idea and changed all school exams to unsupervised. An English quiz in Grade One of Senior High School was not as formal as the mid-term or final exam. I cheated. After being discovered by the English teacher, I was not only punished by corporal punishment, but also taken to the office for one day. For me as a model student, this incident has become a huge trauma.

For a period of time after that, I didn’t want to go to school, and I was not interested in anything. I began to learn and try to master French, which became an opportunity to make up for the trauma. Although it was a kind of self-satisfaction, it did help me through the difficulties.

Tsukagoshi Hirotaka Nakajima:Why study French?

Bai Yongrui:After the recovery of Korea, German was the second foreign language. In my freshman year, I could choose French besides German. I am not interested in law, but I am interested in literature, history, philosophy and French literature, so I naturally choose French. Maybe the aversion to law is too strong.

The experience of cheating in the exam in senior one and the experience of being imprisoned for participating in the student movement just now made me understand how fragile and precarious the "peace" created around me is under external forces.

Tsukagoshi Hirotaka Nakajima:Benjamin’s Childhood in Berlin around 1900 also gives people a premonition that the unique calm state of childhood will be broken. Perhaps everyone will find out after adulthood that if it is not created by themselves, in the words of Professor Bai, it is the "peace" generated by their own judgment, then it will not be realized. Professor Bai experienced this in high school, didn’t he?

Bai Yongrui:I thought I created peace through my own feelings, but in fact, it was not through my own internal judgment, but based on the surrounding environment or the judgment of adults and schools. They think you are excellent, so I cooperate with external judgment to create a kind of peace. This is not the peace created by your own judgment. That "crisis" also gave me a chance to reflect on how fragile the so-called "model" is.

Tsukagoshi Hirotaka Nakajima:Have you participated in student sports since high school?

Bai Yongrui:In high school, I was not interested in student sports. I mentioned Bultmann just now. Actually, I was interested in historical philosophy at that time. However, after entering the university classroom, I found that there is no philosophy of history, but all courses are positivism. This may be influenced by Imperial University of Japan, and teachers have been discussing how to demonstrate historical facts. As a result, I gradually lost my interest in learning and couldn’t read well. Fortunately, students take part in the study meeting on their own-called "society" in Korea, which is similar to an ideological interest group-where they can learn about historical philosophy. In other words, we can discuss such issues as "What are the laws of history and the forces that push history forward", "What is the structure of capitalism" and "Who is the subject of history", and share various experiences with contemporary students.

Benjamin’s Humpty Dumpty: Childhood in Berlin Around 1900

Third, student sports and "learning as sports"

Bai Yongrui:After I went to college, I became interested in the structural problems of Korean society and joined a group aimed at cultivating social activists. Although the ideological interest group I joined had some connection with the student movement, what was more urgent at that time was the "October Reform" incident in Korea in October 1972. That is, President park chung-hee will change the constitution to realize the lifelong presidential system. Revise the constitution, formulate the "Reform Constitution" and move towards dictatorship. This happened in my freshman year. I went to school that morning, and the chariot was parked in front of the gate. The soldiers took control of the gate and drove the students out of the campus. Then, the university entered a state of long-term suspension. People can’t vote for the president directly, which runs counter to the democracy I learned in middle school and university. I can’t forgive the government’s behavior. This has also become an opportunity for me to directly participate in the student movement. The discussion about history study mentioned just now, for me, the influence from the ideological interest group far exceeds the formal university classroom, and its influence has continued to this day. As my own view of learning, I practice "learning as a sport". This is also directly related to the current research.

Tsukagoshi Hirotaka Nakajima:I want to confirm the date. President park chung-hee promulgated the National Education Charter in 1968. At that time, Professor Bai was still a high school student, right?

Bai Yongrui:Grade three.

Tsukagoshi Hirotaka Nakajima:Professor Bai just mentioned that when you go to school, you can choose French as a second foreign language besides German. Is this a system reform because of the promulgation of the National Education Charter?

Bai Yongrui:There may be other reasons for adding two foreign languages. The important educational reform in 1968 was the beginning of military training in schools.

Tsukagoshi Hirotaka Nakajima:Dictatorships and similar regimes are bound to intervene in education and try to change it. The park chung-hee regime has completely intervened and changed this. You entered the university in March 1972, and the university was blocked six months later. How long did this blockade last?

Bai Yongrui:Five months.

Tsukagoshi Hirotaka Nakajima:What happened in the meantime?

Bai Yongrui:Let’s talk about how the Reform Constitution elected the president. First of all, the "National Assembly of the Unified Subject" was established as the appointed body of sovereignty, and the president was indirectly elected through this meeting. Shortly after the October Reform, a meeting was held to elect a president. After that, various systems were improved by issuing presidential decrees. These things happened during the five months when the university was blocked. The regime established in the "Reform coup" became an orthodox regime, during which universities were closed. An exam was held in February, and the term ended.

Tsukagoshi Hirotaka Nakajima: You just said that when Nixon visited China in 1972, China and the United States started dialogue, and the situation in East Asia, including Japan, changed dramatically. As a history student, you should have thought a lot at that time, right?

Bai Yongrui:Let me explain the characteristics of the student movement at that time. The student movement at that time was not so much a political movement to change the system or play a certain political role as a large-scale cultural movement. Recently, some American scholars suggested that the student movement in South Korea in 1970s and 1980s created a "Counter Public Sphere". Let’s not talk about whether we should use this term, but our goal at that time was to build a popular national culture as an alternative to the orthodox culture of nationalism. Participating in the construction of alternative culture is the common value of activists. The main reason why the student movement can last until the 1980s is not only that it is a political movement, but also that it wants to create alternative culture in all fields of social life, and this conceit is the spirit of the student movement.

Tsukagoshi Hirotaka Nakajima:Since the beginning of the increasingly powerful reform system, you have spent this time as a college student.

Bai Yongrui:In April 1974, a large-scale demonstration took place in South Korea. This is a national parade led by college students. The authorities announced that the "All-China Federation of Democratic Young Students" led the March and attempted to create civil strife. They arrested the student leaders, and I was one of them. The All-China Federation of Democratic Young Students is referred to as the "Youth League". In fact, the Youth League of China is not a systematic organization. However, the authorities believe that this is an organization instructed by North Korea to act in a unified manner in an attempt to launch civil strife. I don’t have any officially appointed position, just a parade liaison in Seoul National University.

In the end, I was arrested as one of the masterminds of the civil strife. That parade happened just during the emergency measures taken according to the Reform Constitution, and the whole trial turned into a military trial. I was sentenced to seven years in prison and expelled from the university. At that time, the newspaper reported the Youth League as a criminal organization and attached a grass-roots organization chart. I’m in there, too. They said that behind this "criminal organization" was an organization called the People’s Revolutionary Party, in which spies instructed by North Korea attempted to launch a revolution, including Japanese independent journalists. In fact, the "People’s Revolutionary Party Incident" is part of a large-scale civil strife conspiracy fabricated incident. Later, when Roh Moo-hyun was in power, the case was retried. The court ruled that this was a fabricated event without any factual basis. In 2013, I was acquitted in the final trial, and seven years’ imprisonment was invalid. I was officially rehabilitated.

Tsukagoshi Hirotaka Nakajima:It took nearly forty years.

Bai Yongrui:If you look at my resume, you will find that I seem to have studied in college for nearly nine years. In fact, from 1974 to the end of 1979, I was counted as a "student without citizenship". After the death of President park chung-hee, I was able to resume my studies in March 1980 and then graduated.

Tsukagoshi Hirotaka Nakajima:Before, I went to Jeju with Professor Bai. The "Jeju Island April 3rd Incident" in 1948 was also considered to have North Korea behind the scenes, and many people were killed. Such fabrications keep happening. Just now, you said that there were Japanese independent journalists in the People’s Revolutionary Party incident. What was the connection between the student movements in Korea and Japan at that time?

Bai Yongrui:I don’t think there is a direct connection between the two. Although Japanese and Koreans can bring Japanese books when they study in Korea, it is by no means easy and can easily be regarded as spies. Due to the situation at that time, everyone could not keep in touch with the outside world. After reading the works of the famous brothers Xu Sheng and Xu Jingzhi, you will know that it was a difficult time.

Tsukagoshi Hirotaka Nakajima:The reason why I asked the question just now is because the student movement in Japan was at the end in 1983 when I entered the university, and everyone received a lot of news about the Korean student movement. Therefore, in my impression, students who participated in the Japanese student movement also participated in the Korean student movement, and there is a connection between the student movements in Japan and South Korea. But you just said that it would be regarded as a spy, which seems very difficult!

Fourth, reading life in prison

Tsukagoshi Hirotaka Nakajima:What books did you read in prison? What thoughts have you made?

Bai Yongrui:Although he was sentenced to seven years, the actual detention period was ten months and fifteen days. When I was in prison, my mother took part in the democratization movement. At that time, the democratization movement of the whole society was in full swing. The authorities were forced to make concessions and suspended my sentence. He was released from prison in February 1975. Although I stopped serving my sentence, I was not acquitted, so I could not return to school. Just like parole, you can’t go back to college, and you can’t walk around at will.

There are two books that are very important to my prison life. One is Taijun Takeda’s Sima Qian. After reading this book, I was deeply moved by Sima Qian’s spirit of writing history in a difficult situation. When I read that he was still recording history in prison after being tortured, I couldn’t help crying.

Another book is Li Yongxi’s The Theory of Changing Times, which is the fourth in a series of new books published by the Creation and Criticism Society. This book was lent to me by my cellmate Lee Hae Chan, who later became the prime minister of Roh Moo-hyun’s government. When he lent me a book, he said that after reading this book, you will have a new understanding of the China Revolution and the Vietnam War. Therefore, I take it for granted that this is a Japanese book, and I never thought that there would be such works in Korean books. I secretly got it in prison and found that it was actually a Korean book. There are new ideas about the "Cultural Revolution" in the book, and there are many new understandings of the history of China, including the "Cultural Revolution", which deeply shocked me after reading it. This book has refreshed my understanding of the history of China. It was not the class at Seoul National University that prompted me to revisit the study of China’s history, but the book The Theory of Changing Times that I read in prison.

Except me, all young Koreans in the 1970s were deeply influenced by this book. Including the late President Roh Moo-hyun, this book had an absolute influence on the young people at that time, so Li Yongxi was called "the mentor of the times". From the present point of view, you will feel that he is over-beautifying the "Cultural Revolution" and the Vietnam War. But at that time, during the period of capitalist development after rapid economic growth, various problems emerged in Korean society. This book provided us with a mirror to reflect on reality and understand ourselves. This is the meaning of this book. In short, The Theory of Changing Times is like putting a mirror outside us, so that everyone can reflect on themselves. In this sense, this book, as a weapon to criticize Korean society, has achieved remarkable results. Even now, we should acknowledge its value.

Li Yongxi later wrote Idol and Reason. This title simply and clearly summarizes the mental state of Korean society at that time. ……

In the situation in East Asia at that time, the atmosphere of reconciliation and relaxation policies between China and the United States swept across the country. In such an international situation, the key word "transformation" was generally accepted by Korean society at that time. If we regard this era as an era of transformation, we need new theories that conform to this era. Idol and Reason is a work that meets this requirement. Therefore, Li Yongxi’s works were accepted by many young people at that time.

Tsukagoshi Hirotaka Nakajima:This is "learning as a sport".

Bai Yongrui’s Thoughts of East Asia

V. Changing society through language

Bai Yongrui:After I got out of prison, I was in a state of nothing to do. Criminal police often followed, and the general environment at that time was that the participants in the student movement either engaged in political activities in the wild, or worked in factories under cover, and then formed trade unions to carry out labor movements. These are the ways for people who are interested in the revolutionary movement, but I can’t do it. Later, I became an editor in a publishing house. This publishing house is the "Creation and Criticism Society" that is still related to me (its name was changed to "Chuangpi" in 2003).

Shortly after I got out of prison, I visited teacher Li Yongxi’s home. I admire Teacher Li very much. We read and discussed together, from literature to the revolutionary history of China. At the same time, as an editor, I work with books. Because of some trauma in my mind, or some feeling I have had since childhood, and I like reading and writing, I began to realize that it is my duty to change society through language through editing this job.

Of course, the reason why I think of changing society through language is also related to my personal habits and growing experience. But the most important thing is that I do feel the reform power of language. What impressed me the most was after returning to the university campus in the spring of 1980. At that time, the university wall was covered with posters, on which students quoted Mr. Li Yongxi’s words and extracted sentences from books and magazines published by my creative and critical society, showing the demand for social change. Seeing this, I deeply feel the power of language and how important it is to elaborate ideas.

Tsukagoshi Hirotaka Nakajima:You can feel the vitality of language by quoting the ideas in the books of Teacher Li Yongxi and the Creation and Criticism Society. When I was in college, there were also vertical billboards and posters on campus, but the words on them made people feel old and lifeless. I passed the end of the student movement in Japan, which was completely different from Professor Bai’s experience.

After resuming your studies, you graduated from undergraduate course in August 1981. In March of the following year, I entered the Graduate School of Tankook University (Korean schools graduated in August and entered in March). At that time, many partners who participated in the student movement and colleagues in the creative and critical society were outside the university campus. Who did you mainly act with?

Bai Yongrui:First of all, Lee Hae Chan mentioned just now, and Jin Zhihe, a poet who served his sentence together. Immediately after I got out of prison, I went to see Mr. Li Yongxi and studied the revolutionary history of China with him. Jin Zhihe told me that you shouldn’t be a political athlete or a labor athlete, you should be a scholar. He also said that Teacher Li Yongxi viewed the China issue from a journalist’s point of view. As a scholar, you can study the history of China as an ideological issue or a historical issue, which is exactly what you need now, and this is also your duty.

Six, from the history centered on human history to social humanities.

Tsukagoshi Hirotaka Nakajima:Just talking about Taijun Takeda’s Sima Qian, China’s historiography pays attention to exploring the changes of the times and its reasons, which is different from the emphasis of modern historiography. The history you want to learn from Mr. Li Yongxi is about the historical structure of the China Revolution, but it seems to be a combination of traditional China historiography and modern historiography to discuss how this structure came into being and how it changed.

Bai Yongrui:Professor Nakajima’s comments are very interesting. So far, I haven’t thought deeply about this problem. Now I can explain my thoughts.

Modern historiography expounds history with the system and structure as the center, but China’s viewpoints and narratives focus on people. I think we should find a narrative way that can transcend these two historiography. Therefore, we should focus on "people" first. However, this does not refer to a famous person or related historical stories of China, let alone modern historiography which focuses on system and structure. What I am concerned about is not the "people" themselves, but the relationship between those who live in the system and the structure. This is "history centered on human history". I wonder if I answered your question just now. How to develop history centered on human history is my current research topic.

Tsukagoshi Hirotaka Nakajima:There are also historians like Naito Hunan. Naito’s stories are large in scale, which makes people understand the reasons for the rise and fall of traditional China’s rebellion, but in the end, it encourages the contempt for China at that time. Naito tried to combine the discussion of system and structure in modern historiography with China’s traditional historical narrative in some way, but eventually he lost his critical consciousness of the Japanese status quo.

Compared with Naito’s practice, Professor Bai wants to develop the two methods as two intersecting lines, which is exactly the opposite. In other words, your approach is neither to focus on the characters in China’s rebellion, nor to focus on the system and structure but make the characters disappear from history, as in modern western historiography. Therefore, Professor Bai’s article not only pays attention to human history, making it appear repeatedly, but also has a critical consciousness of the present situation.

Bai Yongrui:I am very grateful to Professor Nakajima for evaluating my research work from that perspective. You said that my research method is completely opposite to that of Naito Hunan, and I was really scared. In any case, Professor Nakajima did point out the direction of future historical research with a novel point of view.

No matter what changes and twists and turns occur in history, history must focus on human history. For me, this is the most important thing. The reason why I regard human history as the main content of historical research is not only because I have paid attention to literature since I was a child, but also because of my later creative activities in the quarterly journal of literary politics, Creation and Criticism, and the Creation and Criticism Society. Creation and Criticism is a comprehensive magazine that involves and intervenes in social movements and the current situation. It has exercised my sensitivity as an editor and a reporter. Later, how to construct and expound the history centered on human history became my main research topic. From this point of view, the crisis of "history as a system" and "history as an academic" is precisely a result of these historical studies ignoring human history. Therefore, in order to get rid of the "institutional" history that caused this crisis and result, I have always emphasized "history as empathy".

Tsukagoshi Hirotaka Nakajima:I’d like to ask Professor Bai again about the relationship between "academic" history. Excuse me, what was written in the graduation thesis of this master’s period?

Bai Yongrui:The undergraduate thesis is about Liang Shuming’s rural construction movement. My master’s thesis originally wanted to write about the May 4th Movement or the Communist Movement, but Mr. Min Douji suggested that, based on your experience, if you do research on the Communist Movement or Radicalism, it is not conducive to finding a job in the university in the future. On the contrary, you should study the Kuomintang movement, which is considered a "reactionary" even in China. Therefore, the master’s thesis wrote Zhu Zhixin, the left wing of the Kuomintang.

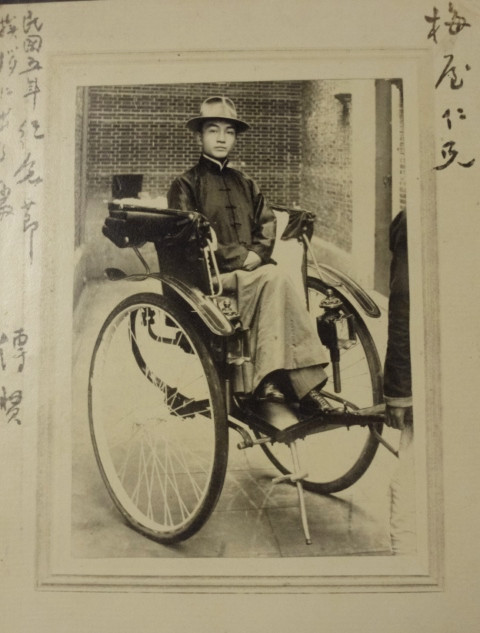

Tsukagoshi Hirotaka Nakajima:I see. My master’s thesis was written by Zhu Zhixin, and later I did research on Dai Jitao who put forward the theory of national revolution.

Bai Yongrui:Zhu Zhixin was also one of the propagandists of Marxism, so he was studied in his master’s thesis. As for Dai Jitao, Japanese Sun Wen Studies introduced my Dai Jitao studies.

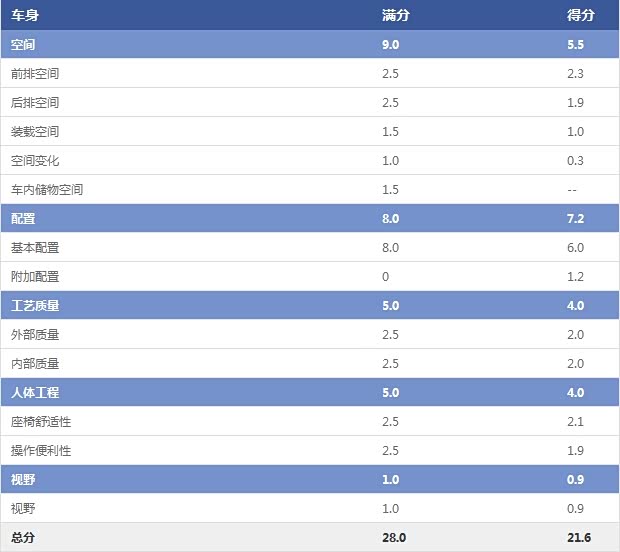

Photo taken on Dai Jitao’s rickshaw (taken in Tokyo in 1916). At the top left of the photo, it says "When I went to greet before the 5 th anniversary of the Republic of China". Hidden in the Meiwu Zhuangji Reference Room.

Tsukagoshi Hirotaka Nakajima:Have you been studying with Mr. Min Douji since you were an undergraduate at Seoul National University?

Bai Yongrui:Teacher Min Douji’s influence on me only became greater after the 1980s.

Tsukagoshi Hirotaka Nakajima:I see. I thought you and Mr. Min Douji knew each other for a long time.

Bai Yongrui:After I got out of prison, I went back to the university campus first. After entering the graduate school, I entered the door of teacher Min Douji.

Tsukagoshi Hirotaka Nakajima:When you first entered Seoul National University, wasn’t Mr. Min Douji there?

Bai Yongrui:When I entered school, Mr. Min Douji was already a teacher at Seoul National University, but he went to Germany for academic leave. Moreover, I have only taken one class, and there is no intersection with Mr. Min.

Tsukagoshi Hirotaka Nakajima:Just now you mentioned that positivism prevailed in the history department, and Mr. Min Douji was not one of them.

Bai Yongrui:In fact, there was another thing that happened. When I submitted my application for admission to the Graduate School of Seoul National University, I was told that I was not qualified for admission. At that time, Mr. Min Douji was very angry with the university’s decision and said that "it is impossible to be unqualified, what is going on". He told me that even if I failed, I could go to the exam first. In the end, I didn’t get into the graduate school of Seoul National University.

Tsukagoshi Hirotaka Nakajima:Therefore, you went to the Graduate School of Tankuo University.

Bai Yongrui:Although I entered the master’s program in the Graduate School of Tankuo University, I received personal guidance from teacher Min Douji for three semesters. This is not a formal research class, but one-on-one personal guidance, including the history of China’s philosophy, the history of Chinese historiography and thesis guidance. After entering the late period of Quan Douhuan’s regime, the social restrictions on former student movement participants were reduced. Unlike when I took the master’s degree, I was able to enroll in the doctoral program of the graduate school of Seoul National University. So, I returned to Seoul National University.

Tsukagoshi Hirotaka Nakajima:So, once again, you are under the door of Mr. Min Douji. What kind of person is Teacher Min Douji?

Bai Yongrui:I once compared the academic achievements of Mr. Min Douji and Mr. Li Yongxi in a critical study of China. For me personally, both of them exist in my heart like prosecutors. Teacher Li Yongxi may ask, can your article become a weapon of social change? Teacher Min Douji may ask, is your article writing based on strict academic norms? I often ask myself these two questions when writing articles.

In addition to South Korea, Mr. Min Douji is also a famous positivist in Japanese societies. But I have been in close contact with him and feel that he is not just a positivist. It is often said that Mr. Min Douji, as a liberal, did not take part in the action to change reality. Although Mr. Min Douji is not directly involved, he will severely criticize the real problems in his essays and other places. In fact, before I took part in the student movement, I had a meeting with Mr. Min Douji once during my undergraduate course. At that time, I wanted to study history and take part in political movements, and I didn’t know which way to choose. So I confessed my troubles to Mr. Min Douji. Now, I have also become a university professor. When students ask such questions, I always find it difficult to answer them. At that time, as a student, I asked this question to Mr. Min Douji. Teacher Min Douji suggested that I should strictly distinguish between "words and deeds as a citizen" and "words and deeds as a scholar", and recommended Max Weber’s "Learning as a Career". I opened the book with great expectation, expecting to read an exciting article, but Weber was throwing cold water on it and the content was serious. I gave up before I finished reading, and was later arrested and imprisoned for participating in the student movement. At that time, what bothered me was how to combine "learning as a system" with "learning as a movement", and how to distinguish and combine "words and deeds as a citizen" and "words and deeds as a scholar" that Teacher Min Douji said. Today, I am still looking for these answers.

Some people who know my relationship with Mr. Min Douji will wonder why people like Mr. Min Douji tolerate people like me who are keen on real politics and have been arrested and imprisoned for participating in the student movement. In this regard, I want to say at first that Mr. Min Douji is not only a positivist, but also a magnanimous person who can tolerate people like me. Dare not talk about the teacher’s private affairs, just say one thing. Teacher Min Douji was born in Jeolla-do, which was once a fierce guerrilla battlefield during the Korean War. Mr. Min Douji had a predecessor who died in guerrilla warfare. This predecessor was intelligent and eager to learn, and he was excellent. Before he took part in guerrilla warfare, he told Mr. Min Douji: I entered the war for the sake of righteousness. Although I can’t continue my studies, you must continue reading. The elder entrusted his full ambition to Mr. Min Douji, and Mr. Min Douji kept this agreement.

Tsukagoshi Hirotaka Nakajima:What a great teacher! At that time, you were studying under Mr. Min Douji, and at the same time, your intersection with the real society, especially with Creation and Criticism, was deepening. Through publishing work, contact with the society in different forms with student movements. Under Mr. Min Douji, your research has become more rigorous. These are things that Professor Bai grasped with both hands at that time. Excuse me, how do you promote knowledge research and social activities at the same time

Bai Yongrui:I’m still worrying about this problem. How to combine both at the same time? This is not only my personal problem, but also a problem related to my own research theme "academic history research" In other words, research is carried out around "learning as a movement" and "learning as a system", in which we objectively think about our identity. In this sense, the Japanese version of my book contains two articles that I like very much. One is The Birth and Decline of Oriental History, and the other is A Critical Study of China. I want to do some research on Korean studies and Japanese studies from this perspective as much as possible in the future.

Whether it is academic research or social activities, I am carrying on with these troubles. Before that, he served as the dean of the National Studies Institute of Yonsei University for seven years, and established HK(Humanities Korea, the national research project of Korea "Humanities Korea") with "Social Humanities" as the research theme. During these years, my colleagues and I have been thinking about how to combine "learning as a system" with "learning as a sport".

Whether we use the terms "learning as a sport", "learning as a system" and "social humanities" or not, we do meet companions who share the same values and think together everywhere. In the future, I want to move the main venue of the activity to the creation and criticism society outside the university, so that the social humanities can continue to carry forward.

Tsukagoshi Hirotaka Nakajima:From the beginning as an editor, Professor Bai has always had an intersection with the Creation and Criticism Society. Recently, you have become the main member, and your relationship with the agency has gone further. Excuse me, what is your relationship with Mr. Bai Leqing, editor-in-chief of Creation and Criticism?

Bai Yongrui:Because there are very few people with the surname "Bai" in Korea, some people speculate whether there is a blood relationship between me and teacher Bai Leqing. Actually, we are not related. Because of teacher Li Yongxi, I got to know teacher Bai Leqing. Teacher Li Yongxi was sued for "The Theory of Changing Times" and "Idol and Reason". As a publisher, Creative and Criticism Society made teacher Bai Leqing a "joint principal offender", but he was not arrested and put on record, but helped teacher Li Yongxi to join the lawsuit. So, I naturally got to know Mr. Bai Leqing.

At first, I worked as an editor in the Creation and Criticism Society, and later I participated in publishing as a graduate student and a university professor, which lasted for 30 years. I often think about my role in the creative and critical society. As an editor, an editorial board member and an editor’s main force, I have spent these thirty years.

I have reached the age of hearing. Looking back, my friends and colleagues who participated in the student movement all entered the field of political or social movements, while I, as a university professor and editor, have been dealing with books. For me, this kind of life choice is very consistent with my own endowment and meaningful. I am really lucky to be able to produce knowledge as a professor and a researcher, and at the same time to spread knowledge as an editor. Compared with the career as a scholar, the career as an editor is longer. From now on, I want to continue to work hard to do these two jobs.