Shocked! Is it illegal to do cross-border e-commerce?

Once a cross-border e-commerce enterprise violates the tax law, it needs to bear criminal responsibility and non-criminal responsibility. Non-criminal liability should first pay taxes, second pay fines, and third pay late fees. The late fees are 18.25% annualized and the fines are 0.5 -5 times. The other is criminal responsibility. According to Articles 201-205 of the Criminal Law, the maximum sentence can be life imprisonment. Therefore, in order to enable cross-border e-commerce enterprises to develop in a long-term and better way, fiscal and taxation compliance is both the general trend and imperative.

The most important compliance is tax. The domestic e-commerce law aims at us to do pure export trade e-commerce, because the income is overseas, not in China. Many sellers have asked, what impact does this have on cross-border e-commerce? If we also do import e-commerce, such as Tmall and Taobao, it matters a lot, but it doesn’t matter if we do export.

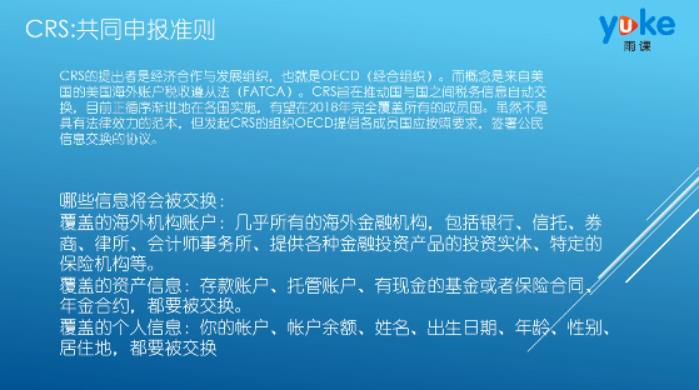

The CRS common declaration standard, that is, global taxation, before 2017 and 2018, many sellers have registered offshore accounts, and funds may flow overseas. Since the implementation of CRS, this piece is almost inevitable, and all information will be exchanged. In the past, it would have been good for funds to go to overseas personal accounts, but now it is not.

Why do we have to let people pay attention to CRS? Because global taxation is in China, as long as it belongs to China resident taxpayers, as long as there is income, it needs to be declared.

So how on earth should we achieve compliance?

Pay according to domestic tax laws, in fact, compliance is very simple. However, our input invoices are not available, especially for small and medium-sized sellers, so it is difficult to comply with the tax. On the mainland side, taxes are set by votes, and if there is income, taxes will be paid.

If you have funds to spend, but you can’t offset the tax without the invoice, the tax for this kind will be very high.

For example, at the purchasing end, you have expenses, but because you have not obtained the cost ticket, you can’t offset the tax. It’s very high to pay taxes according to the full amount of income. Before income tax, it was 25%, and the value-added tax was 13%. After payment, it may be reversed.

So how to solve the tax problem?

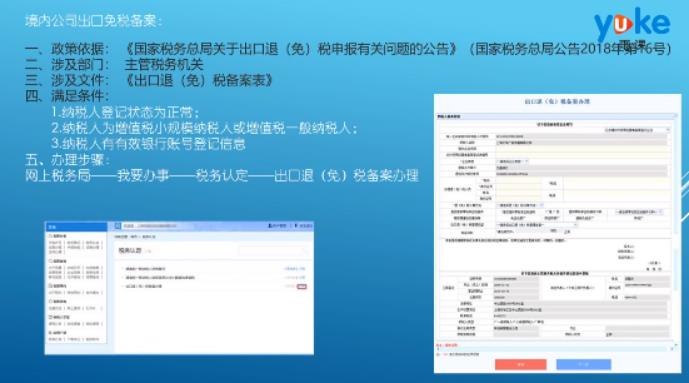

One is value-added tax, and the other is income tax. For our cross-border sellers, the most important issue is income tax, because the state stipulates that export value-added tax is exempt. As long as you have the right to import and export, you can go abroad for tax-free filing and purchase without invoices. At the same time, income tax is divided into personal income tax and enterprise income tax. From the current point of view, income tax of most enterprises has been avoided, because the funds have gone to individuals. The income that should have been borne by the company did not go to the public account, but went to the private account, that is, this tax was passed on to the personal income tax, but has the personal income tax been paid? In the case of income, it is illegal not to pay taxes, and in life, personal income tax bears greater risks.

How to solve the current personal tax problem?

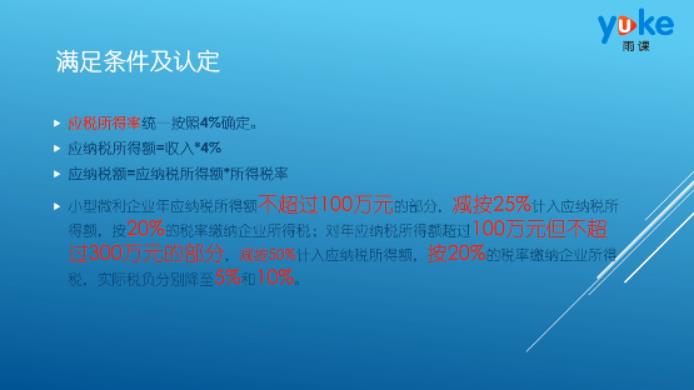

The New Deal came out at the end of last year and was officially implemented on February 1 this year. The policy of 4% cross-border e-commerce income tax:

New Deal calculation method:

Explaining the appeal policy, the taxable income rate is uniformly determined by 4%, such as 10 million sales, the payable income is 10 million times 4% which is 400,000 (payable income), and then multiplied by 5% according to the payable income, which is to pay 20,000 yuan (small and micro enterprise policy), and the tax amount is controlled below 2,000.

It’s much lower than before, but many sellers can’t take the New Deal.

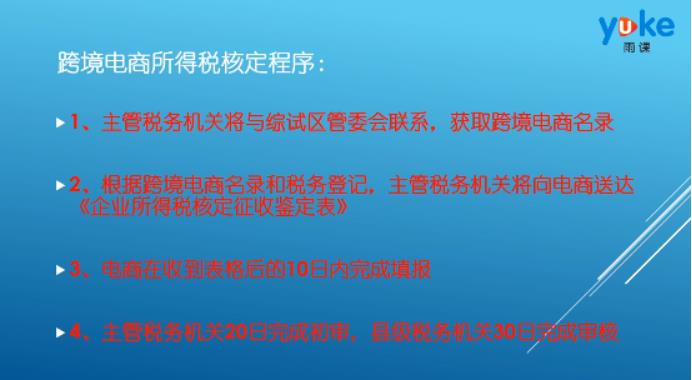

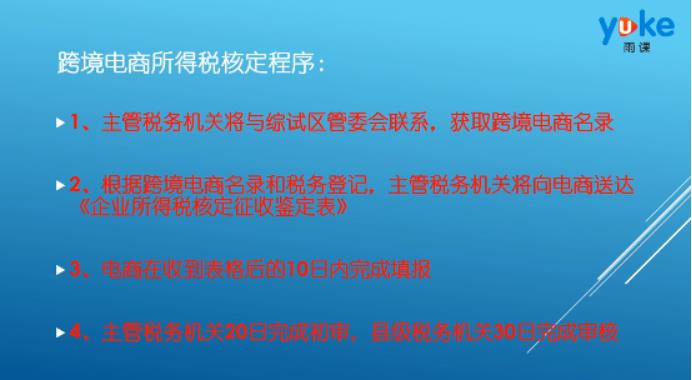

First of all, to use this policy, we must go through the approval process. At present, most areas have not formally implemented the new policy because:

First, there are many supporting measures that have not come out, so it is difficult to go through the procedure. Second, you have to have a lot of qualifications to go through the procedure.

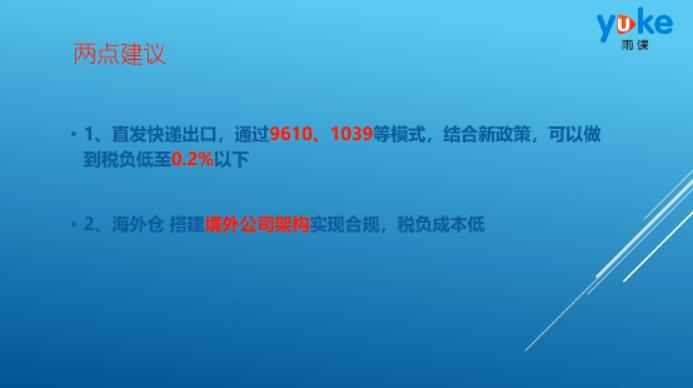

In this regard, Yin Binzhi proposed two ways to reduce taxes:

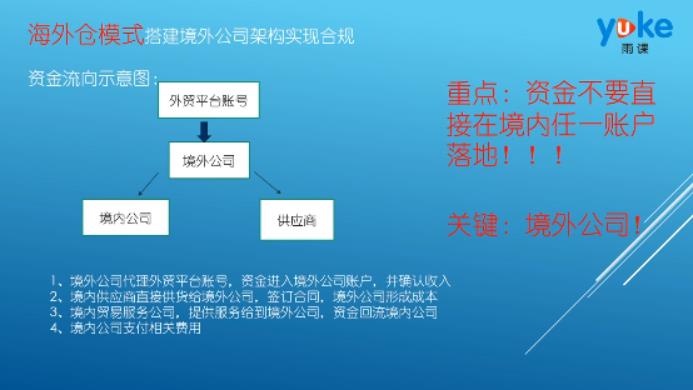

The taxation of overseas warehouses is more advantageous. How can we build a compliance framework for overseas warehouses?

(Note: Overseas companies don’t need invoices, just pro forma invoices.)

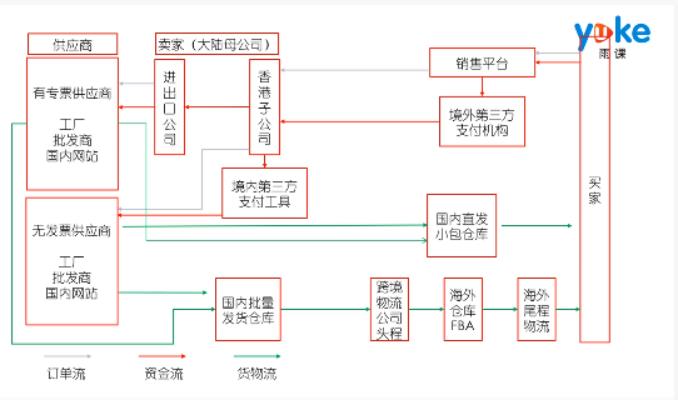

The scheme adopted by most sellers:

Compliance method: the parent company in mainland China files overseas investment and sets up a subsidiary in Hong Kong. If there is an invoice, the parent company will be used for normal tax refund; Without an invoice, use a third-party tool to carry out capital settlement, so that the flow between individuals and companies will be reduced.

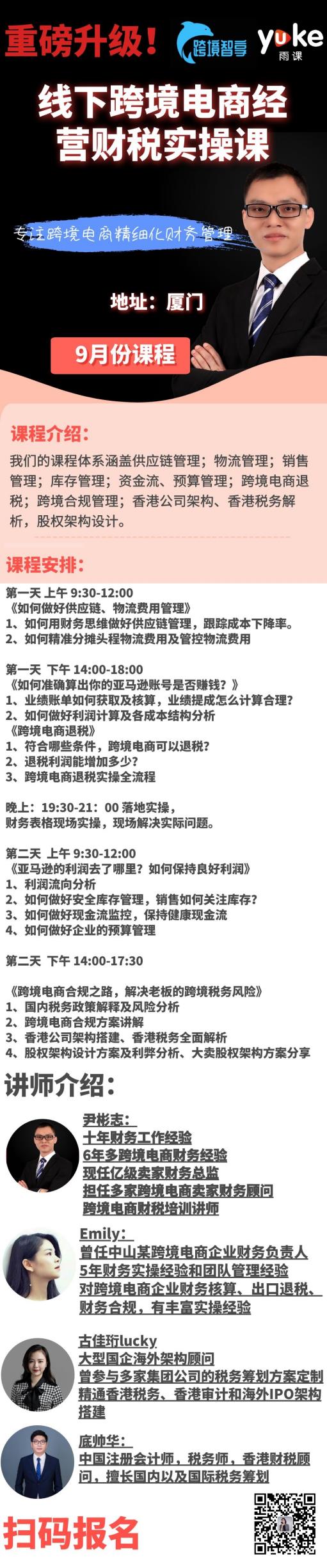

The above are the methods of reasonable tax avoidance and compliance management put forward by lecturer Yin Binzhi. The lecturer Yin Binzhi is currently the financial director of cross-border e-commerce sellers, the financial consultant of several cross-border e-commerce enterprises and the tax collector of cross-border e-commerce. He has more than 6 years of financial work experience in cross-border e-commerce, and his content is well received!

Click here to learn more!

Editor: Jiang Tong